Sapporo: Eliud Kipchoge pulled away late and no one could come close to catching him as the 36-year-old from Kenya defended his Olympic marathon title.

Kipchoge finished in 2 hours, 8 minutes, 38 seconds on a breezy and humid Sunday along the streets of Sapporo. It was more than 80 seconds ahead of runner-up Abdi Nageeye of the Netherlands. Bashir Abdi of Belgium earned bronze to close out the track and field portion of the Tokyo Games.

Really, this was a running clinic. Kipchoge smiled along the way and even fist-bumped a fellow racer. Kipchoge becomes the third athlete to win multiple gold medals in the men's marathon, joining Abebe Bikila (1960, '64) and Waldemar Cierpinski ('76, '80).

Kipchoge, wearing white-and-pink Nikes, took off around the 30-kilometer mark and never looked back. Well, once, near the finish. There was no one even close.

On a day with plenty of cloud cover, Kipchoge cruised. The temperature was around 77 degrees Fahrenheit (25 Celsius) at the start and climbing to 84 (29). The men's race stayed at the same time after the women's race was moved up an hour the day before to avoid the heat.

It was humid, though, at 81% as the runners wound their way through Sapporo, which is located about 500 miles (about 830 kilometers) north of Tokyo. The race was moved to escape the extreme heat, but it was about the same temperature in Tokyo and rainy.

Taking the starting line were 106 runners. Finishing were far less, with more than two dozen not finishing. The top American was Galen Rupp in eighth place.

Along the way, runners were treated to actual fans clapping and cheering. One fan even brought drums, making the atmosphere feel almost normal. Spectators haven't been allowed in the venues during the Tokyo Olympic due to coronavirus protocols.

The fans saw a dominating performance from Kipchoge, who was a huge favorite as both the defending champion from Rio de Janeiro and the world record holder (2:01:39). In October 2019, he became the first to complete a marathon in under two hours. The time didn't count as a world record, though, because it wasn't held under race conditions.

Already etched in the Kenyan record books, Kipchoge added another chapter: He joined Kip Keino and Vivian Cheruiyot on the women's side as the only ones from the country to win four Olympic medals.

In addition to his marathon golds, Kipchoge also has silver ('08) and bronze ('04) in the 5,000 meters.

Kipchoge diligently trained at elevation to get ready for this race. He said the key to running "is not magic science. It's not rocket science, to be at the top for a long time."

Instead, he attributes his "systems" for his success teammates who can push him and a coach who can teach.

"I have what it deserves for me to actually stay long," he said.

This may or may not be his last big race. He played coy when asked about it recently.

"You'll still see me around," Kipchoge said.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

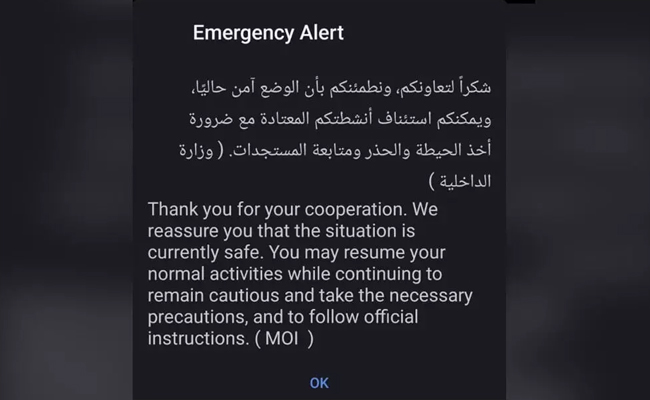

Dubai/Abu Dhabi: Residents and visitors across the United Arab Emirates received a fresh emergency alert on their mobile phones stating that the situation in the country is currently safe.

The message, issued by the Ministry of Interior (MOI), thanked people for their cooperation and reassured them that conditions were stable.

“Thank you for your cooperation. We reassure you that the situation is currently safe. You may resume your normal activities while continuing to remain cautious and take the necessary precautions, and to follow official instructions. (MOI),” the alert read.

The notification was sent in both Arabic and English through the country’s emergency alert system.

The advisory comes after earlier alerts warning of potential missile threats amid rising regional tensions. Authorities have urged the public to stay cautious and follow official guidance.