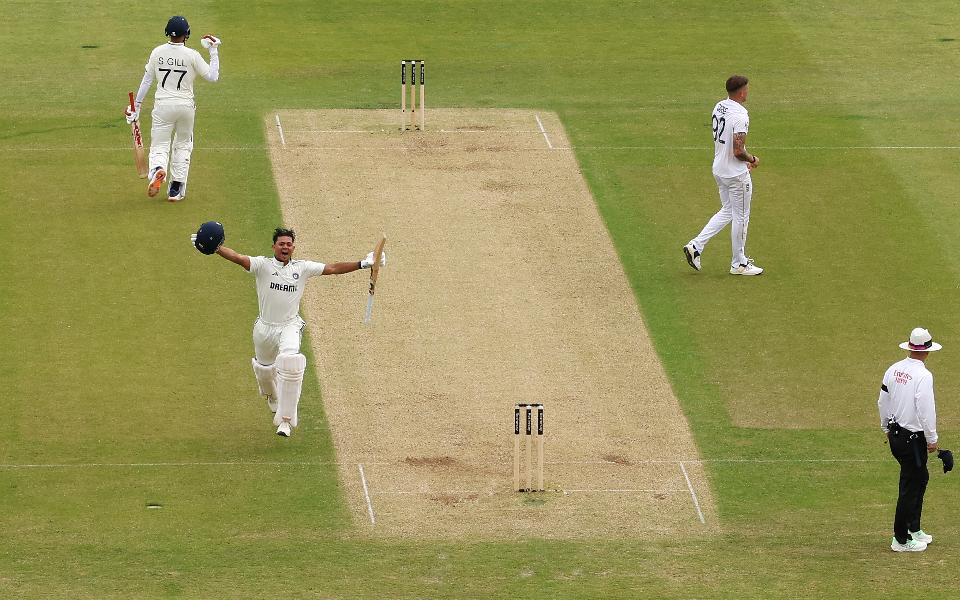

Leeds, Jun 20 (PTI): Yashasvi Jaiswal and captain Shubman Gill announced their readiness to carry India's batting into the post Virat Kohli-Rohit Sharma era, striking marvellous hundreds to guide the visitors to a dominant 359 for three against a faltering England on the first day of the opening Test here on Friday.

Gill (127 batting) and Jaiswal (101, 159b) shared a 129-run partnership for a determined third wicket alliance that carried India to 221 from a slightly wobbly 92 for two after KL Rahul (42) and debutant B Sai Sudharsan (0) were dismissed in quick succession.

Rishabh Pant (65 batting) was keeping vigil with Gill at close.

But there was an underlying significance to the centuries of Jaiswal and Gill other than giving India a head-start on the first day of the newly-minted five-match Anderson-Tendulkar Trophy.

This Indian batting line-up is a tad thin on experience after the recent retirements of former skippers Kohli and Rohit, who played at the pivotal No. 4 and opening slots in their illustrious careers.

Both Jaiswal and Gill are not newcomers to the unforgiving Test arena, but there has been this widespread anxiety over how the 'New Gen' India stars would step into the big shoes of their predecessors.

But the portends are quite bright, if the day's innings by Jaiswal and Gill are anything to go by.

Jaiswal was the first to reach the three-figure mark, the fifth in his flourishing career, off 144 balls and Gill reached his own landmark off 140 balls in the final passage of the day, heralding the start of a new era in Indian cricket.

But the way they reached that point was entirely different. Jaiswal eschewed his natural flair as the first session offered its own share of assistance to the English bowlers in the shape of movement and carry.

However, it was an altogether different matter that the home bowlers were not prudent enough to exploit that offering, and later the pitch eased up considerably.

But a flaccid track and a fangless England attack without James Anderson or Stuart Broad could not take the sheen out of the knocks of Jaiswal and Gill.

It was not a typical Jaiswal innings where he simply flayed the bowlers around, but he showed admirable self-restraint, particularly outside the off-stump.

The left-hander was dismissed in that channel a couple of times while playing for India A against the England Lions in the recent tour matches, but here the 23-year-old did not repeat his mistakes.

Jaiswal began the morning session with a gorgeous drive through mid-off off pacer Chris Woakes, and he only grew in confidence from there.

Perhaps, the only time he showed his aggressive mindset was when the left-hander carted pacer Josh Tongue for a six and then later hammered him for two consecutive fours to reach 99.

It was Jaiswal's first innings in England, and he made it memorable, making a hundred soon after scampering for a single despite suffering some cramps on his hands.

He celebrated with gusto too — a roar and leap into the Headingley sky. England could not be blamed for imagining the Indian batter repeating his 712-run effort he managed last year during a home series.

If Jaiswal’s innings was more about adaptation, Gill’s knock was all about following his natural batting doctrine, which has its fundamentals in timing and elegance.

The right-hander played shots with minimum follow-through through on-side and with a flourish on the off-side.

The 25-year-old's languid grace wowed the crowd when he essayed an off-drive off Chris Woakes and followed it up with a dreamy clip off the pads for a four as currently England's second most experienced Test bowler went for nearly five runs an over across the first two sessions.

Once he went past the fifty off just 56 balls, Gill slowed down a touch, and nerves grew once he went past 90.

There was a cheeky uppish shot through the gully of Tongue and a full-stretched dive saved him from a potentially close run out.

But Gill did not want to let go of the opportunity to score a hundred in his first innings as India's Test captain.

He brought up that mark with a sumptuous boundary off Tongue, getting a standing ovation from everyone.

Gill also joined a very exclusive club of Vijay Hazare, Sunil Gavaskar, Dilip Vengsarkar and Virat Kohli as the Indian batters with hundreds on their captaincy debut.

However, the blooming alliance ended when the giant-hearted England skipper Ben Stokes produced a peach to rattle the stumps of Jaiswal immediately after tea.

Gill carried on nevertheless in the company of his adventurous deputy Pant, who in the process of making his 16th Test fifty completed 3000 runs in the format.

Gill and Pant added 138 runs for the unfinished fourth wicket stand, and it has the potential to produce more sparkling moments on Day 2.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

When you go to a shop and the shopkeeper says, “Price badh gaya hai, naya tax laga hai,” you usually do only one thing — you sigh and pay more. You do not argue with the government; you simply adjust your household budget. That is exactly what is happening in the United States right now. And when prices and taxes change in America, the effect does not stay there. It slowly travels across oceans and reaches India too.

On 21 February, American President Donald Trump announced a new 15% import tax on almost all goods entering the US from other countries. An import tax, also called a tariff, is simply extra money charged when a product crosses the border — like a gate fee. A T-shirt from Tiruppur, a medicine from Hyderabad, or an electronic item from China — if it wants to enter the US market, it must now pay 15% extra. Companies usually pass this extra cost to customers. So in the end, it is the ordinary American buyer in a supermarket who pays more.

This 15% tax did not come out of nowhere. Just one day earlier, on 20 February, Trump had announced a 10% global import tax. Before that, he had introduced even higher tariffs, which the US Supreme Court struck down. The court said he was misusing a law called the International Emergency Economic Powers Act (IEEPA). That law is meant for genuine emergencies — like dealing with hostile nations or blocking dangerous financial flows — not for imposing wide import taxes on almost the entire world. In simple terms, the court said normal trade cannot be labelled an emergency just to collect extra tax.

So Trump turned to another legal option: Section 122 of the Trade Act of 1974. This rarely used law allows a president to impose temporary import surcharges when there is a serious trade imbalance. It permits tariffs of up to 15%, but only for 150 days — roughly five months. That is why it feels like a 150-day fuse. The law was originally designed for situations when the US was buying far more from other countries than it was selling to them — what economists call a trade deficit. Trump argues that America’s large and long-standing trade deficit justifies this step.

However, legal experts are divided. Some believe today’s trade deficit may not fully match the conditions envisioned when Section 122 was written decades ago. That means the new tariff could also face legal challenges. But until any court decision changes it, the 15% tariff is active.

The numbers explain the shift clearly. Before the Supreme Court struck down the earlier tariffs, the average import tax in America had risen to about 16%. After the court ruling, it fell sharply to around 9%. Now, with the new 15% global tariff, analysts expect the overall average to settle somewhere between 13% and 14%. In simple words, tariffs are lower than last year’s peak but higher than they were just days ago. They have not returned to old normal levels.

Why does this matter for India? Because the US is one of India’s largest export markets. India sends medicines, IT services, textiles, gems and jewellery, engineering goods, and auto components to America. If a 15% tariff is applied, Indian exporters face a difficult choice. Either they absorb the extra cost and accept lower profits, or they raise prices and risk losing customers. Lower profits often mean slower hiring, reduced investment, and cautious spending. Trade policy may look distant, but it quietly influences jobs and incomes here at home.

Earlier discussions between India and the US involved a possible 18% tariff structure. On paper, 15% seems better. But the earlier framework was clearer and more stable. The new 15% tariff comes with a 150-day time limit and the possibility of court battles. In business, predictability is often more valuable than small numerical advantages. Companies can manage higher costs if they are stable; uncertainty is harder to manage.

There are some exemptions. Certain medicines, critical minerals, defence-related goods, and some products from Canada and Mexico are excluded under special agreements. So the rule is not entirely universal. But for a large share of imports — including many low-cost online products — the 15% tariff applies.

Another important change concerns the “de minimis” rule. Earlier, goods valued at 800 dollars or less could enter the US without paying import tax. This allowed online sellers and platforms to ship small packages directly to American consumers easily. That benefit is now effectively suspended. The administration has confirmed that even these small parcels will face the new tariff. In addition, a major tax bill passed recently will permanently phase out the de minimis system for commercial shipments by around mid-2027.

Trump has also mentioned other legal tools. Section 232 of the Trade Expansion Act of 1962 allows tariffs on industries linked to national security, such as steel, aluminium, and automobiles. Some of these sectors already face tariffs of 25% to 50%. The new 15% global tariff will not be added on top of those existing Section 232 tariffs. Another option, Section 301 of the Trade Act of 1974, allows long-term tariffs on countries accused of unfair trade practices. However, both Section 232 and Section 301 require detailed investigations and take months to implement. Section 122, in contrast, acts quickly.

What happens on the ground? Studies from the Federal Reserve Bank of New York suggest that most of the cost of earlier tariffs was ultimately paid by American companies and consumers. When importers pay more, they try to pass that cost along the supply chain. This leads to higher prices for goods like home appliances, furniture, and vehicles. Some companies delay hiring or postpone expansion plans.

Not everyone loses. Certain domestic industries benefit from protection. For example, US shrimp fishermen have said that higher tariffs on imported shrimp made their local products more competitive. In trade policy, one sector’s protection often means another sector’s higher cost.

The broader issue is stability. Tariffs are powerful economic tools. But when they change frequently or face repeated legal challenges, businesses struggle to plan. They hesitate to invest, hire, or sign long-term contracts. Uncertainty itself becomes a cost.

Trump believes America has been disadvantaged in global trade and wants to strengthen domestic manufacturing. Many supporters agree that protecting key industries and reducing dependence on foreign supply chains is important. The debate is less about the objective and more about the method. A major trading nation needs policies that are clear, predictable, and legally sound.

Trade policy may appear technical, but it has everyday consequences. It can influence the price of shoes in a shop, the hiring decision of a factory in Chennai, or the expansion plan of an exporter in Gujarat.

Trump’s 15% global tariff and its 150-day timeline are not just political headlines. They represent a shift in how trade costs are distributed across countries and consumers. And in global economics, the final bill almost always reaches ordinary people — whether they wrote the rules or not.

(Girish Linganna is an award-winning science communicator and a Defence, Aerospace & Geopolitical Analyst. He is the Managing Director of ADD Engineering Components India Pvt. Ltd., a subsidiary of ADD Engineering GmbH, Germany.)

Disclaimer: The views and opinions expressed in this article are solely those of the author. They do not necessarily reflect the views, policies, or position of the publication, its editors, or its management. The publication is not responsible for the accuracy of any information, statements, or opinions presented in this piece.