Kingston: Virat Kohli has surpassed Mahendra Singh Dhoni to become India's most successful Test skipper after the team recorded its 28th win under his leadership, a 257-run hammering of the West Indies here.

The 28 wins have come from 48 matches for Kohli as captain. His predecessor Dhoni led India to 27 wins from 60 Test matches during his tenure.

Sourav Ganguly and Mohammad Azharuddin are third and fourth in the list of successful Indian Test skippers with 21 and 14 wins respectively.

Overall, former South Africa skipper Graeme Smith remains the most successful skipper in the world with 53 Test wins, followed by ex-Australia captain Ricky Ponting, who recorded 48 Test wins in his captaincy tenure.

India have made a superb start to the World Test Championship and the win in the second match not only helped them sweep the series 2-0 but also put them on top of championship points table.

With 120 points from two games, India lead the nine-team table even though Pakistan, Bangladesh and South Africa are yet to begin their bilateral campaigns in the championship.

Under Kohli, India have achieved some memorable victories in both India and abroad. Earlier this year, India clinched their maiden Test series in Australia, beating the hosts 2-1 in their own backyard.

In the match here, India entered the fourth day needing eight wickets to win and Kohli's men completed the task after lunch, dismissing the hosts for 210 in 59.5 overs in their chase of a near-impossible target of 468.

The bowling quartet of Ishant Sharma (2/37 in 12 overs), Mohammed Shami (3/65 in 16 overs), Jasprit Bumrah (1/31 in 11 overs) and lone spinner Ravindra Jadeja (3/58 in 16.5 overs) were relentless in their pursuit of keeping the home team batsmen on a tight leash.

Such was India's dominance in the two Tests that West Indies couldn't even cross 250 in any of their four innings and the only half-century was scored by Shamarh Brooks (50) in this game.

It was one of the most satisfying tours for skipper Kohli as his team claimed dominating triumphs in all three formats (3-0 in T20Is, 2-0 in ODIs, and 2-0 in Tests).

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

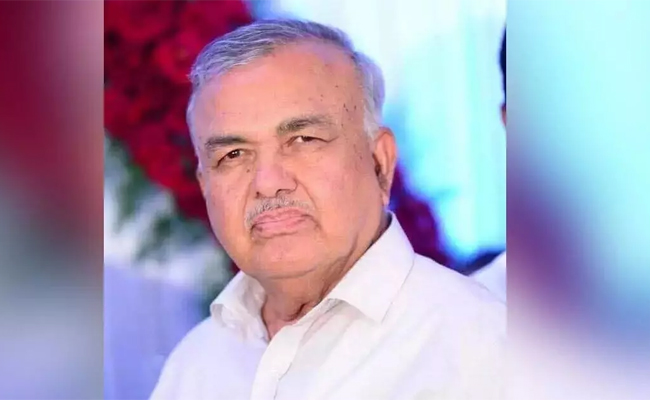

New Delhi (PTI): HK Dua, a distinguished journalist and a veteran of Indian public life who held the rare distinction of helming editorial operations at three of India's leading newspapers, passed away on Wednesday at the age of 88.

He breathed his last peacefully this afternoon at a private hospital, a member of his family said.

His cremation will take place at Lodhi Road crematorium on Thursday.

Dua was admitted to the hospital around three weeks ago. He was survived by wife Adity and son Prashant.

In a remarkable career spanning over four decades, Dua traversed the world of journalism, served as a media advisor to two prime ministers -- Atal Behari Vajpayee and HD Deve Gowda -- and transitioned into the roles of a diplomat and parliamentarian.

A Padma Bhushan recipient, Dua was known for his affable persona, sharp political insight and unwavering commitment to editorial independence. He commanded respect across the political spectrum.

Dua served as editor of The Hindustan Times (1987-94), Editor-in-Chief of The Indian Express (1994-96) and The Tribune (2003-09) and Editorial Advisor for The Times of India (1997-98).

Born on July 1, 1937, Dua also served as India's ambassador to Denmark (2001-2003).

He was a nominated member of Rajya Sabha (2009-2015), where he contributed significantly to debates on foreign affairs and national security. He was also part of several high-profile parliamentary committees, including the Standing Committee on Foreign Affairs and the Consultative Committee for the Ministry of Home Affairs.

A two-term president of the Editors' Guild of India and a steadfast defender of democratic values, Dua also served on the National Security Advisory Board and received honorary doctorates from Punjab and Kurukshetra Universities for his contributions to the Fourth Estate.

Apart from the Padma Bhushan, he received several awards, including the Durga Ratan award and the Bal Gangadhar Tilak award for excellence in journalism.

Leaders across the political spectrum and members of the media fraternity expressed condolences over Dua's demise.

"My deepest condolences on the passing of H K Dua, a distinguished journalist, diplomat, and Padma Bhushan recipient whose commitment to truth, editorial independence, and public service enriched public discourse," Congress president Mallikarjun Kharge said on social media.

Shiromani Akali Dal President Sukhbir Singh Badal said Dua upheld editorial independence with unwavering integrity, sharp insight, and commitment to democratic values.

"His contributions as a journalist and an editor across leading newspapers leave behind an enduring legacy," he said.

Congress MP Shashi Tharoor said: "A journalistic giant has left us."