Rio de Janeiro, Aug 31: Yashaswini Singh Deswal stunned former Olympic and world champion Olena Kostevych of Ukraine to secured India's ninth Olympic quota in shooting after she fired her way to the women's 10m air pistol gold in the ISSF World Cup here on Saturday.

The 22-year-old former junior world champion recorded a score of 236.7 in the eight-women final of the season's fourth World Cup for pistol and rifle shooters.

World no.1 Kostevych claimed the silver with 234.8, while Serbia's Jasmina Milavonovic bagged the beonze with 215.7.

Yashaswini, a student of Economics, had also the topped the qualifications by a mile, aggregating a score of 582.

Playing her fifth senior World Cup and only her second final, Yashaswini led from the first shot, but for the 15th when she fell just 0.1 behind.

She, however, regained her lead on the 16th shot of the 24-shot final.

The Indian though fumbled in between, like during the 21st shot when she scored a 9.7 as against Kostevych's 10.9.

But she roared back in style immediately with a 10.5 to stay clear of the race.

Her two final shots where in the 9s, but importantly both were higher than those of her Ukranian opponent to emerge as the champion.

Among other Indian competitors in the event, Annu Raj Singh shot 572 for a 21st place finish while Shweta Singh finished 31st with a score of 568 in the qualifying.

Earlier in the day Kajal Saini of India delivered a hugely improved performance in the women's 50m Rifle 3 Positions (3P) by finishing 22nd with a qualifying round score of 1167.

Former world champion in prone, Tejaswini Sawant finished 47th with a score of 1156.

In the men's 25m Rapid Fire Pistol, Adarsh Singh and Anish Bhanwala shot 291 out of 300 in the first precision round to be in 13th and 14th spots respectively.

Anhad Jawanda, the third Indian in the fray, shot 281 to be in 48th spot.

The trio will comeback for the final Rapid Fire round on Sunday to try and make it among the top six finalists.

The Indians also continued to do well in the non-competition Minimum Qualification Score (MQS) section. Manu Bhaker and Esha Singh finished 1-2 in the women's 10m Air Pistol, shooting scores of 580 and 577 respectively.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

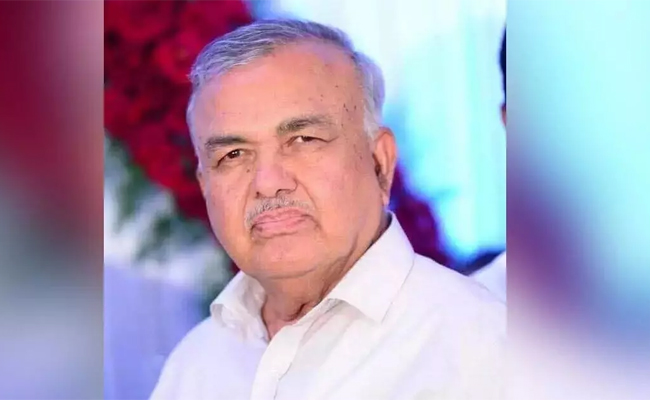

New Delhi (PTI): HK Dua, a distinguished journalist and a veteran of Indian public life who held the rare distinction of helming editorial operations at three of India's leading newspapers, passed away on Wednesday at the age of 88.

He breathed his last peacefully this afternoon at a private hospital, a member of his family said.

His cremation will take place at Lodhi Road crematorium on Thursday.

Dua was admitted to the hospital around three weeks ago. He was survived by wife Adity and son Prashant.

In a remarkable career spanning over four decades, Dua traversed the world of journalism, served as a media advisor to two prime ministers -- Atal Behari Vajpayee and HD Deve Gowda -- and transitioned into the roles of a diplomat and parliamentarian.

A Padma Bhushan recipient, Dua was known for his affable persona, sharp political insight and unwavering commitment to editorial independence. He commanded respect across the political spectrum.

Dua served as editor of The Hindustan Times (1987-94), Editor-in-Chief of The Indian Express (1994-96) and The Tribune (2003-09) and Editorial Advisor for The Times of India (1997-98).

Born on July 1, 1937, Dua also served as India's ambassador to Denmark (2001-2003).

He was a nominated member of Rajya Sabha (2009-2015), where he contributed significantly to debates on foreign affairs and national security. He was also part of several high-profile parliamentary committees, including the Standing Committee on Foreign Affairs and the Consultative Committee for the Ministry of Home Affairs.

A two-term president of the Editors' Guild of India and a steadfast defender of democratic values, Dua also served on the National Security Advisory Board and received honorary doctorates from Punjab and Kurukshetra Universities for his contributions to the Fourth Estate.

Apart from the Padma Bhushan, he received several awards, including the Durga Ratan award and the Bal Gangadhar Tilak award for excellence in journalism.

Leaders across the political spectrum and members of the media fraternity expressed condolences over Dua's demise.

"My deepest condolences on the passing of H K Dua, a distinguished journalist, diplomat, and Padma Bhushan recipient whose commitment to truth, editorial independence, and public service enriched public discourse," Congress president Mallikarjun Kharge said on social media.

Shiromani Akali Dal President Sukhbir Singh Badal said Dua upheld editorial independence with unwavering integrity, sharp insight, and commitment to democratic values.

"His contributions as a journalist and an editor across leading newspapers leave behind an enduring legacy," he said.

Congress MP Shashi Tharoor said: "A journalistic giant has left us."