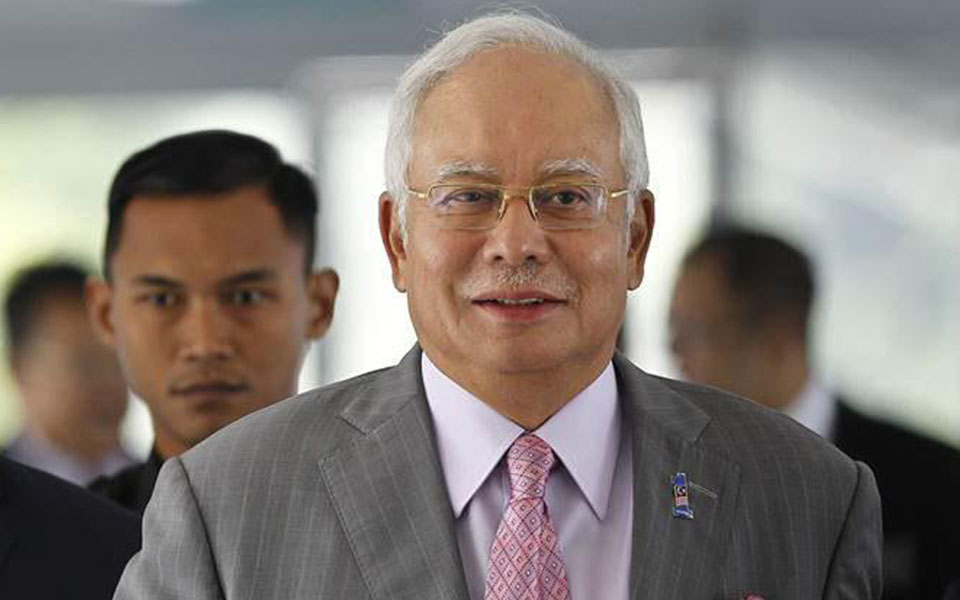

Kuala Lumpur, May 22: Former Malaysian Prime Minister Najib Razak arrived at the national anti-corruption body headquarters here on Tuesday to record his statement in a 2015 scandal involving state investment company 1MDB.

Razak arrived at the Malaysian Anti-Corruption Commission's (MACC) Putrajaya office around 9.45 a.m. amid tight security, the star reported.

He was summoned to assist in the investigation regarding the SRC International, a subsidiary of 1MDB, which he had set up in 2009 after taking office.

It is alleged that he took hundreds of millions of dollars which were siphoned by his associates, Xinhua news agency reported quoting an MACC officer as saying.

Razak has consistently denied any wrongdoing related to 1MDB since the scandal erupted in 2015, but he replaced an attorney-general and several MACC officers to shut down an investigation.

The Malaysian Police last week seized a trove of cash, jewellery, and designer handbags from several premises related to Razak, including his private residence and luxury condominiums, as part of the corruption probe following the election.

Newly elected Prime Minister Mahathir Mohamad has vowed to hold Razak responsible if found guilty.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Mangaluru: A 57-year-old man has allegedly been cheated of Rs 10.55 lakh by online fraudsters who lured him into investing in a so-called digital gold trading platform through Instagram, Deccan Herald reported on Tuesday.

According to the complaint, the victim was browsing Instagram at his residence on November 12, 2025, when he received a message from an account named “Suhani Patel.” The accused initiated a friendly conversation and later persuaded him to invest in the “digital gold market,” promising high returns.

The accused subsequently shared a mobile number and sent a link via WhatsApp, asking the complainant to install an application called “Kanak Daam Exchange.” Following the instructions, the victim downloaded the app and registered.

ALSO READ: Ex-Union Minister K P Unnikrishnan dies at 89

The accused told the complainant that all transactions would be handled through the app’s customer service. Following their instructions, the complainant contacted the customer service through the app and sent a message requesting US dollars in exchange for Indian rupees. He was then directed to transfer money to specific bank accounts provided by the accused.

Trusting the claims, the complainant transferred Rs 1,50,000, Rs 3,45,000 and Rs 5,60,000 in multiple transactions, amounting to a total of Rs 10,55,000.

Subsequently, the app displayed that his total investment had grown to Rs 60 lakh. However, when he attempted to withdraw the amount due to personal financial needs, the request was denied. On contacting customer service, he was informed that he would have to pay 30 per cent of the total amount as “tax” before any withdrawal could be processed.

Growing suspicious, the complainant reportedly consulted officials at Canara Bank, who advised him that it was a fraud and warned him not to transfer any more money. When he confronted the accused, the amount displayed in the app was allegedly reduced to zero, and he was blocked from further communication.

Despite further attempts to contact “Suhani Patel,” the accused allegedly continued to assure him that the lost money would be returned, before eventually blocking him.

The complainant stated that he was cheated between November 12, 2025 and February 27, 2026, and has urged police to take action against the fraudsters.

A case has been registered, and further investigation is underway.