New Delhi/Zurich, Jun 20 (PTI): Indian money parked in Swiss banks more than tripled in 2024 to 3.5 billion Swiss francs (nearly Rs 37,600 crore) on the back of a huge jump in funds held through local branches and other financial institutions, annual data released by Switzerland's central bank showed on Thursday.

However, money in customer accounts of Indian clients rose by only 11 per cent in the year to 346 million Swiss franc (nearly Rs 3,675 crore) and accounted for just about one-tenth of overall funds.

The sharp increase in the overall funds follows a 70 per cent decline in funds parked by Indian individuals and firms in Swiss banks, including through local branches and other financial institutions, in 2023 to a four-year low of 1.04 billion Swiss francs.

This is the highest since 2021, when the total Indian money in Swiss banks had hit a 14-year-high of CHF 3.83 billion.

These are official figures reported by banks to the Swiss National Bank (SNB) and do not indicate the quantum of the much-debated alleged black money held by Indians in Switzerland. These figures also do not include the money that Indians, NRIs or others might have in Swiss banks in the names of third-country entities.

The total amount of CHF 3,545.54 million, described by the SNB as 'total liabilities' of Swiss banks or 'amounts due to' their Indian clients at the end of 2023, included CHF 346 million in customer deposits (up from CHF 310 million at 2023-end), CHF 3.02 billion held via other banks (up from CHF 427 million), CHF 41 million (up from CHF 10 million) through fiduciaries or trusts, and CHF 135 million as 'other amounts' due to customers in form of bonds, securities and various other financial instruments (down from CHF 293 million).

The total amount stood at a record high of nearly 6.5 billion Swiss francs in 2006, after which it has been mostly on a downward path, except for a few years including in 2011, 2013, 2017, 2020, 2021, 2022 and 2023, as per SNB data.

According to the SNB, its data for 'total liabilities' of Swiss banks towards Indian clients takes into account all types of funds of Indian customers at Swiss banks, including deposits from individuals, banks and enterprises. This includes data for branches of Swiss banks in India, as also non-deposit liabilities.

On the other hand, the 'locational banking statistics' of the Bank for International Settlement (BIS), which have been described in the past by Indian and Swiss authorities as a more reliable measure for deposits by Indian individuals in Swiss banks, showed an increase of nearly 6 per cent during 2024 in such funds to USD 74.8 million (nearly Rs 650 crore).

It had dropped by 25 per cent in 2023, by 18 per cent in 2022 and by over 8 per cent in 2021, after rising by nearly 39 per cent in 2020.

This figure takes into account deposits as well as loans of Indian non-bank clients of Swiss-domiciled banks and had shown an increase of 7 per cent in 2019, after declining by 11 per cent in 2018 and by 44 per cent in 2017.

It peaked at over USD 2.3 billion (over Rs 9,000 crore) at the end of 2007.

Swiss authorities have always maintained that assets held by Indian residents in Switzerland cannot be considered as 'black money' and they actively support India in its fight against tax fraud and evasion.

An automatic exchange of information in tax matters between Switzerland and India has been in force since 2018. Under this framework, detailed financial information on all Indian residents having accounts with Swiss financial institutions since 2018, was provided for the first time to Indian tax authorities in September 2019 and this is being followed every year.

In addition to this, Switzerland has been actively sharing details about accounts of Indians suspected to have indulged in financial wrongdoings after the submission of prima facie evidence. Such exchange of information has taken place in hundreds of cases so far.

The overall funds of foreign clients, including institutions, declined to CHF 977 billion in 2024, from CHF 983 billion at the end of 2023. In terms of assets, Indian clients accounted for CHF 1.59 billion at the end of 2023, an increase of about 9 per cent from the previous year.

While the UK topped the charts for foreign clients' money in Swiss banks at CHF 222 billion, it was followed by the US (CHF 89 billion) at the second spot and West Indies (CHF 68 billion) at the third place.

These three were followed in the top 10 by Germany, France, Hong Kong, Luxembourg, Singapore, Guernsey and the UAE.

India was placed at 48th place, up from 67th at the end of 2023, but below 46th place at the end of 2022.

Pakistan also saw a dip to CHF 272 million (from CHF 286 million), while Bangladesh witnessed a sharp increase from CHF 18 million to CHF 589 million. Just like in India, the issue of alleged black money in Swiss banks has been a political hot potato in the two neighbouring countries as well.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

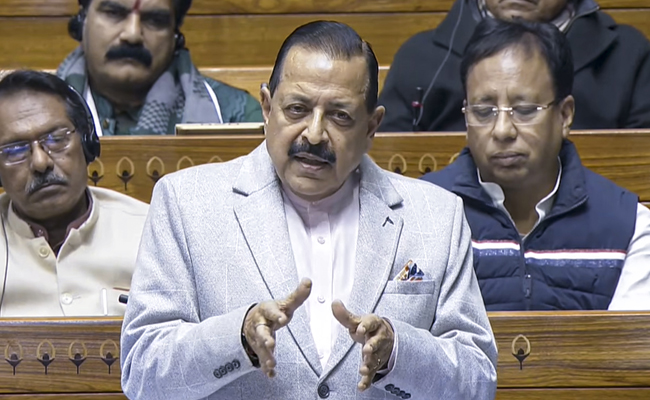

New Delhi (PTI): Lok Sabha on Wednesday passed the nuclear energy bill with Union minister Jitendra Singh asserting that it would help India achieve its target of 100 GW atomic energy generation by 2047.

The Sustainable Harnessing and Advancement of Nuclear Energy for Transforming India (SHANTI) Bill, which seeks to open the tightly-controlled civil nuclear sector for private participation, was passed by voice vote amid a walkout by the opposition.

Singh termed the bill a "milestone legislation" that will give a new direction to the country's developmental journey.

"India's role in geopolitics is increasing. If we have to be a global player, we have to follow global benchmarks and global strategies. The world is moving towards clean energy. We too have set a target of 100 GW of nuclear energy capacity by 2047," he said.

The opposition contended that the bill diluted provisions of the Civil Liability for Nuclear Damage Act, 2010 that passed on the liability for a nuclear incident on to the suppliers of nuclear equipment.