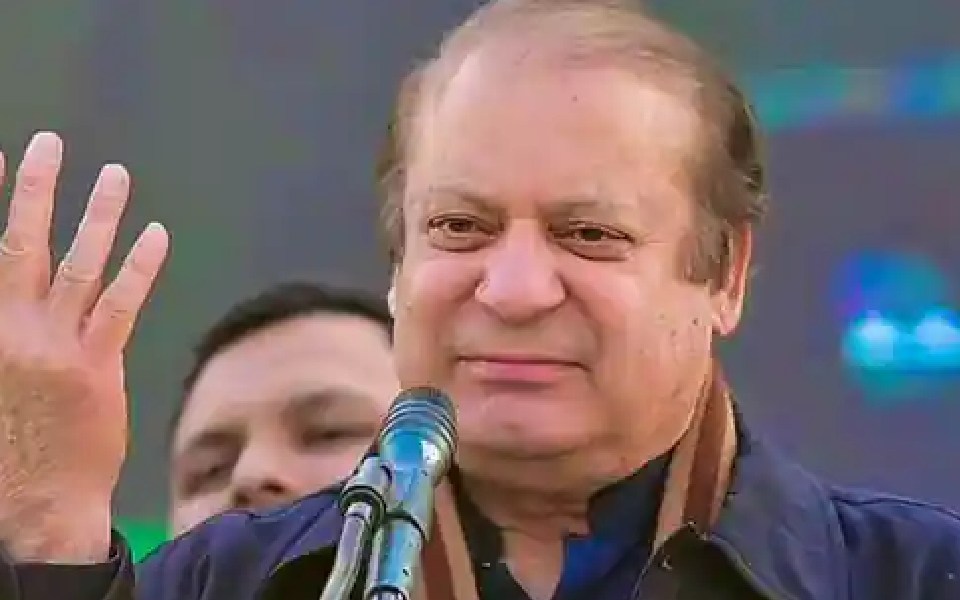

Lahore, May 28: Former Pakistan premier Nawaz Sharif on Tuesday admitted that Islamabad had "violated" an agreement with India signed by him and ex-prime minister Atal Bihari Vajpayee in 1999, in an apparent reference to the Kargil misadventure by Gen Pervez Musharraf.

"On May 28, 1998, Pakistan carried out five nuclear tests. After that Vajpayee Saheb came here and made an agreement with us. But we violated that agreement...it was our fault," Sharif told a meeting of the PML-N general council that elected him president of the ruling party six years after he was disqualified by the Supreme Court.

Sharif and Vajpayee signed the Lahore Declaration on February 21, 1999, after a historic summit here. The agreement that talked about a vision of peace and stability between the two countries signalled a major breakthrough, but a few months later Pakistani intrusion in the Kargil district in Jammu and Kashmir led to the Kargil War.

"President Bill Clinton had offered Pakistan USD 5 billion to stop it from carrying out nuclear tests but I refused. Had (former prime minister) Imran Khan like a person been on my seat he would have accepted Clinton's offer," Sharif said on a day when Pakistan marked the 26th anniversary of its first nuclear tests.

Sharif, 74, talked about how he was removed from the office of the prime minister in 2017 on a false case by then chief justice of Pakistan Saqib Nisar. He said all cases against him were false while the cases against Pakistan Tehreek-e-Insaf (PTI) founder leader Imran Khan were true.

He also talked about the role of former ISI chief Gen Zahirul Islam in toppling his government in 2017 to bring Imran Khan into power. He asked Imran Khan to deny that he was not launched by the ISI.

"I ask Imran not to blame us (of being patronised by the army) and tell whether Gen Islam had talked about bringing the PTI into power," he said and added Khan would sit at the feet of the military establishment.

The three-time premier talked about receiving a message from Gen Islam to resign from the office of prime minister (in 2014). "When I refused, he threatened to make an example of me," he said.

Sharif also praised his younger brother Prime Minister Shehbaz Sharif for standing by his side through thick and thin. "Efforts were made to create differences between us but Shehbaz remained loyal to me. Even Shehbaz was asked to become PM in the past and leave me but he declined," he said.

Sharif said after assuming the office of the PML-N President he would renew efforts to strengthen the party.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Visakhapatnam (PTI): Shafali Verma hit a blistering unbeaten 69 as India made short work of a paltry target to outclass Sri Lanka by seven wickets in the second Women’s T20 International here on Tuesday.

India now lead the five-match series 2-0 after another one-sided victory, having restricted Sri Lanka to a modest 128 for 9 through a collective display of disciplined bowling from the spin trio of seasoned Sneh Rana, ably complemented by young spinners Vaishnavi Sharma and Shree Charani.

During the chase, vice-captain Smriti Mandhana (14) fell cheaply but Shafali, enjoying new found confidence after a stellar show in the World Cup final, sent the bowlers on a leather-hunt during her 34-ball knock, winning it for her team in just 11.5 overs.

The hosts have now completed back-to-back successful chases within 15 overs which speaks volumes about the unit's sky-high confidence.

Shafali's innings had 11 punchy boundaries apart from a maximum.

The floodgates opened when left-arm spinner Inoka Ranaweera bowled a few flighted deliveries and Shafali would step out everytime to hit her over extra cover. Her footwork against slow bowlers was immaculate whether stepping out to loft the ball or rocking back to punch or pull.

Seeing her confidence, the newly appointed Delhi Capitals skipper Jemimah Rodrigues (26 off 15 balls) also attacked as the duo added 58 runs in just 4.3 overs.

By the time Rodrigues was out trying to hit one six too many, the match as a contest was over. Shafali completed her half-century off just 27 balls and completed the formalities in a jiffy.

Earlier, off-spinner Rana, who got a look-in after Deepti Sharma was ruled out due to fever, showed her utility keeping the Lankan batters under tight leash with figures of 1 for 11 in 4 overs, including a maiden which certainly is a rarity in T20 cricket.

Charani, who made an impression during India's ODI World Cup triumph, took 2 for 23 in her quota of overs, while Vaishnavi after an impressive debut in the opening encounter, finished with 2 for 32, not letting the Islanders get easy runs in her second spell.

The last six wickets fell for just 24 runs, but what stood out during India’s bowling effort was their superb ground fielding. After a patchy show in the previous game, the improved sharpness in the field resulted in three run-outs.

Sri Lankan skipper Chamari Athapaththu (31 off 24 balls) looked in good nick as she deposited length deliveries from seamers Kranti Gaud and Arundhati Reddy over the ropes but it was Rana, who kept her quiet by repeatedly pitching on good length.

Unable to manoeuvre the strike and with the big hits suddenly drying up, Athapaththu chanced her arm at another delivery in which Rana had shortened the length slightly.

Not having transferred the weight into the lofted shot, Athapaththu's hoick was pouched cleanly by Amanjot Kaur at long-off.

This was after Athapaththu's opening partner Vishmi Gunaratne (1) had offered a simple return catch to Gaud.

Hasini Perera (22 off 28 balls) and Harshitha Samarawickrama (33 off 32 balls) did stitch a stand of 44 but they could never set the tempo against the Indian spin troika.

Once Hasini offered a tame return catch off a Charani full-toss, Sri Lankans never recovered and lost wickets in a heap towards the end.