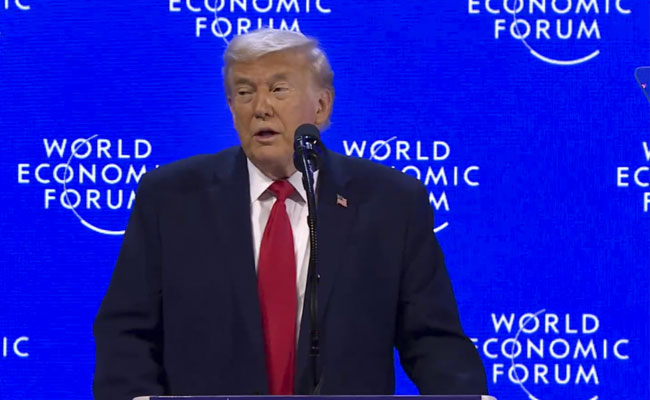

Copenhagen: A far-right Norwegian lawmaker said Wednesday that he has nominated US President Donald Trump for the Nobel Peace Prize for his efforts in the Middle East.

Christian Tybring-Gjedde, a member of the Norwegian Parliament for the far-right Progress Party, said Trump should be considered because of his work for a peace agreement between the United Arab Emirates and Israel which opens up for possible peace in the Middle East.

No matter how Trump acts at home and what he says at press conferences, he has absolutely a chance at getting the Nobel Peace Prize, Tybring-Gjedde, told The Associated Press.

He said he nominated Trump on Wednesday, adding that Donald Trump meets the criteria for the Nobel Peace Prize.

Tybring-Gjedde was also one of two Norwegian lawmakers who nominated Trump for the peace prize in 2018 for his efforts to bring reconciliation between North and South Korea.

Any national lawmaker can nominate someone for the Nobel Peace Prize.

The process of considering candidates and awarding the prize is done in Norway, in contrast to the other Nobel Prizes, which are awarded in neighbouring Sweden.

Nominations must be sent to the Norwegian Nobel Committee by February 1.

The Norwegian Nobel Committee doesn't publicly comment on nominees. Under its rules, the information is required to be kept secret for 50 years.

It is now to hope that the Nobel Committee is able to consider what Trump has achieved internationally and that it does not stumble in established prejudice against the US President, Tybring-Gjedde said in a Facebook post. (

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

After rapper and singer Santy Sharma's reaction to Khushi Mukherjee's provocative photo/video posts on social media, people on different platforms are now having a heated debate. The comments made by Santy were soon spread across social media and opened the door for conversations surrounding the type of content that is being posted by public figures on social media.

In his view, digital platforms provide a way to express themselves through creativity and art; however, he feels it is important for celebrities/influencers with a large number of followers to be mindful of how their content may be perceived by others. According to him, people who possess a large following online have a level of responsibility regarding the actions they display via their social media and should be cognizant of what type of example they are setting for the youth.

Lastly, creating art should inspire creativity as well as allow users to use their voices to support necessary change in society; therefore, creativity and expression through digital platforms should produce positive social change while still being aware of culture and society's expectations.

At the time of writing, Santy Sharma was discussing how online behaviour has contributed to increased rates of rapes, which stimulated much debate and debate online. Supporters have advocated for improved online etiquette, while others feel he was insensitive in his comments and contradicts the need for sensitivity on these sensitive issues. The controversy has gone beyond social media and increased debate regarding gender-based issues, the ethics of media influence, and the necessity to address serious crimes with appropriate awareness and sensitivity.

Meanwhile, Santy Sharma has also announced his upcoming single titled “I Don’t Care,” which is scheduled to release on 10 March 2026. The track will be available on his official YouTube channel and other major music streaming platforms, creating anticipation among fans who are eager to hear his latest musical release.