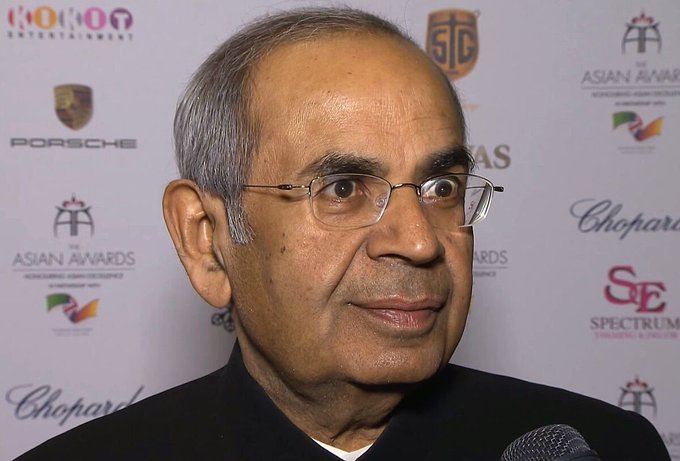

London (PTI): Gopichand P Hinduja, the head of Britain's richest family, who was named as an accused in the Bofors scam with his two brothers, died in London at the age of 85.

Fondly known as 'GP' in business circles, Gopichand P Hinduja was unwell for the past few weeks and died in a London hospital, sources close to his family said.

Born in 1940, Gopichand was the second of the four Hinduja brothers who built the group into a global conglomerate, spanning automotive, energy, banking, and infrastructure. After the death of his elder brother Srichand Hinduja in 2023, he took charge as the chairman of the 35 billion pound Hinduja Group.

He is survived by his wife, Sunita, sons Sanjay and Dheeraj, and daughter, Rita.

A graduate of Jai Hind College, Mumbai (1959), Gopichand began his career in the family's trading business in Tehran before expanding its reach across continents.

Under his leadership, the group acquired Gulf Oil in 1984, closely followed by the acquisition of the then-struggling Indian automotive manufacturer, Ashok Leyland, in 1987, which was the first major NRI investment in India.

Today, Ashok Leyland is regarded as one of the most successful turnaround stories ever in Indian corporate history.

He was also the visionary behind the Group's forays into power and infrastructure sectors, spearheading the task of shaping the conglomerate's plan for building multi-GW energy generation capacity in India.

Known for his understated style and deep commitment to family values, he was honoured with an honorary Doctorate of Law from the University of Westminster and an Honorary Doctorate of Economics from Richmond College, London, as per the group's website.

He and his two other brothers - Srichand and Prakash Hinduja - were accused of receiving payments totalling Rs 64 crore in illegal commissions to help Swedish gunmaker AB Bofors secure an Indian contract. All three were, however, exonerated by the Delhi High Court in 2005.

Gopichand Hinduja and his family retained their position as Britain's wealthiest, according to the latest The Sunday Times Rich List, despite a drop in their overall fortune. The Hinduja family's net worth stands at 35.3 billion pounds, down from 37.2 billion pounds the previous year.

Their UK property assets include the 67,000 square feet 18th-century Carlton House Terrace near Buckingham Palace and the historic Old War Office building in Whitehall, now home to the Raffles London hotel, which opened in September 2023 to great fanfare.

The family, however, feuded over the vast wealth. After the death of the eldest brother, Srichand, in 2023, it emerged that Gopichand and his two younger brothers - Prakash, 79, and Ashok, 74, had been fighting over the past three years with the patriarch and his daughter, Vinoo, over a 2014 letter signed by the four siblings that said assets held by one of them belonged to all.

While the family called a truce on the bitter power struggle, reports suggest they're still privately haggling on related issues.

Their father, Parmanand, founded their namesake business in 1914 in the Sindh region of British India, trading in carpets, tea and spices. In 1919, he moved from Sindh (then in India, now Pakistan) to Iran, and his sons joined as the group rapidly diversified investments, with early success distributing Bollywood films outside India.

Parmanand, who died in 1971, instilled in his sons a mantra they pledged to follow: "Everything belongs to everyone and nothing belongs to anyone". The siblings, however, feuded over control of the vast business empire and have reportedly agreed to effectively dump the letter, raising the prospect of a breakup for their conglomerate.

The Hinduja empire included the only Indian-owned Swiss bank, SP Hinduja Banquee Privee, with headquarters in Geneva. Its assets include Mumbai-based lender IndusInd Bank Ltd and a property investment firm that has bought more than 250 acres of land in major Indian cities.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Bengaluru (PTI): Karnataka Commerce and Industries Minister M B Patil on Monday asserted that Aequs continues to expand in the state and that its proposed investment in neighbouring Tamil Nadu was a business decision aimed at diversification, not a shift away from Karnataka.

Reacting to criticism on social media over reports that the Karnataka-based firm had signed a major investment deal in Tamil Nadu's Krishnagiri district for setting up a specialised aerospace and defense manufacturing cluster, he said the state government was fully aware of the company's plans and remained confident about its long-term commitment to Karnataka.

"While we welcome every major investment in India, would like to clarify a few points," Patil said in a post on 'X'.

Aequs was significantly expanding its footprint within Karnataka, including a Rs 3,000 crore investment in Kolar for electronics manufacturing.

"Its recently approved Rs 1,500 crore ECMS project will also be grounded in the state. Karnataka remains central to its long-term strategy," he said.

Patil added that the government had prior knowledge of the TN proposal.

The government was already informed and aware that the TN investment is a business decision aimed at geographic diversification and de-risking operations, not a shift away from Karnataka.

"Healthy competition between states strengthens India's manufacturing ecosystem," he said.

Emphasising the state's focus on high-technology sectors, Patil said, "We remain committed to deepening Karnataka's leadership in aerospace and advanced manufacturing, and our engagement with industry partners is strong and ongoing."

The Aequs Group has pledged Rs 4,000 crore to bolster Tamil Nadu's aerospace manufacturing capabilities at the SIPCOT-Shoolagiri Industrial Park in Krishnagiri district.

The group proposes to establish a specialised aerospace and defense manufacturing cluster for the production of aircraft engines, gearbox components, and precision engineering parts. This initiative is expected to provide employment to 7,000 individuals.