Mumbai (PTI): Equity benchmark indices declined in early trade on Monday dragged by Reliance Industries and Kotak Mahindra Bank along with weak global market trends.

The 30-share BSE Sensex tanked 504 points to 80,100.65 in early trade. The NSE Nifty dropped 168.6 points to 24,362.30.

Among the Sensex pack, Kotak Mahindra Bank, Reliance Industries, Larsen & Toubro, ICICI Bank, IndusInd Bank and Axis Bank were the biggest laggards.

UltraTech Cement, NTPC, HDFC Bank and Power Grid were among the gainers.

HDFC Bank climbed 1.57 percent after the company's consolidated net profit grew 33.17 percent to Rs 16,474.85 crore in the June 2024 quarter.

In Asian markets, Seoul, Tokyo and Shanghai were trading lower while Hong Kong quoted in the positive territory.

The US markets ended lower on Friday. Global oil benchmark Brent crude climbed 0.67 percent to USD 83.18 a barrel.

Foreign Institutional Investors (FIIs) bought equities worth Rs 1,506.12 crore on Friday, according to exchange data.

The BSE benchmark hit its new all-time high of 81,587.76 in the initial trade on Friday but failed to carry forward the winning momentum and tanked 738.81 points or 0.91 percent to settle below the 81,000-mark at 80,604.65.

The NSE Nifty tumbled 269.95 points or 1.09 percent and ended at 24,530.90 after hitting its fresh record peak of 24,854.80 during the opening bell on Friday.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

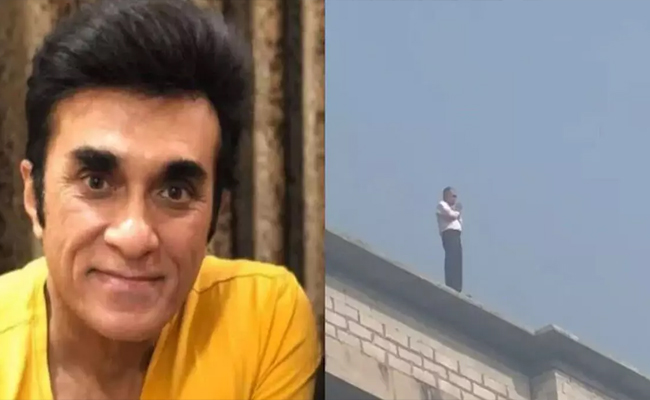

Ranchi (PTI): A Ranchi-based businessman died allegedly by suicide by jumping from the sixth floor of his apartment here, police said on Friday.

The incident took place around 10:30 pm on Thursday in Hindpiri police station area, they said.

“The deceased, Anurag Sarawgi, was heard speaking to someone over the phone in a loud tone. The door of his room was bolted from inside. He then suddenly jumped from the sixth floor of the apartment,” SP (City) Paras Rana told PTI.

No suicide note was recovered from his room, Rana said.

A thorough investigation is underway, the SP added.

(Assistance for overcoming suicidal thoughts is available on the state’s health helpline 104, Tele-MANAS 14416.)