Instant messaging platform WhatsApp users will be able to connect with up to 32 connections simultaneously on voice and video calls, transfer up to 2GB files and add up to 1,024 members in a group, the company said on Thursday.

Besides, Whatsapp users will be able to broadcast messages to up to 5,000 users, who are part of their community and participate in polls, the company said, ”Today, we’re launching Communities on WhatsApp. It makes groups better by enabling sub-groups, multiple threads, announcement channels, and more. We’re also rolling out polls and 32-person video calling too. All secured by end-to-end encryption so your messages stay private,” Meta Founder and CEO, Mark Zuckerberg said on Facebook.

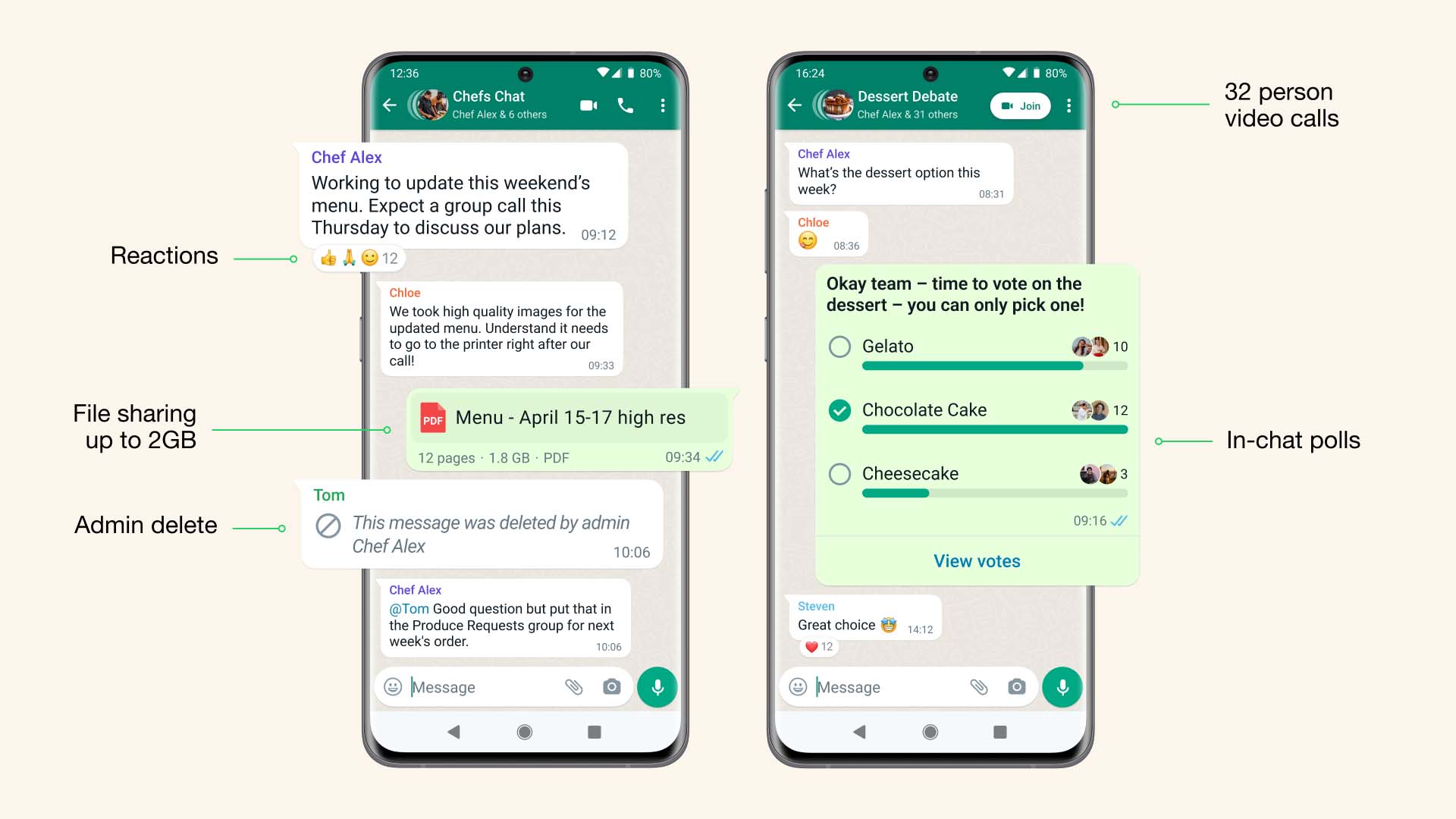

The company announced the feature in April and has started rolling them now, which will be gradually available to all users in the next few weeks. The Meta-owned platform is rolling out in-chat polls and will allow file transfer of up to 2GB files, which was limited to up to 16 MB earlier.

”WhatsApp is also releasing three more features: the ability to create in-chat polls, 32-person video calling, and groups with up to 1,024 users. Just like emoji reactions, larger file sharing, and admin delete, these features can be used in any group but will be particularly helpful for Communities,” the company said.Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Kalaburagi: Four men have been arrested in Kalaburagi on charge of hacking a man with lethal weapons and pelting stones at him under the limits of Station Bazaar Police Station recently.

According to police sources, Anand Jalak Shinde (34), Ashitosh Jalak Shinde (30), Imran Mehboob Sheikh (28) and Sohaib Anwar Qureshi have been arrested. The men are accused of the brutal murder of Syed Mehboob, a resident of Station Bazaar Upper Line Hamalawadi in the city.

An FIR was filed by the Station Bazaar Police Station based on a complaint given by Syed Ismail, father of the deceased Syed Mehboob.

Following quick probe, the police team successfully arrested the suspects within 24 hours. The arrested men were produced in court and have been sent to judicial custody.

The City Police Commissionerate has appreciated in an official release the police team’s quick solving of the murder case and arrest of the four men accused of murdering Syed Mehboob.