New Delhi, Dec 2: Actor Nora Fatehi appeared before the Enforcement Directorate here on Friday for a fresh recording of her statement in connection with an ongoing money-laundering probe against alleged conman Sukesh Chandrashekhar and his associates, official sources said.

Fatehi, 30, has been questioned by the federal agency in the case a few times in the past. The Canadian-born artiste came to India about seven to eight years ago to work in the Hindi film industry.

Sources said the actor, known for her dance numbers in Bollywood films, will be questioned about some more issues related to Chandrashekhar. Her statement is being recorded under the Prevention of Money Laundering Act (PMLA).

She is understood to be being questioned on some new facts that have emerged in the case.

The ED, in its earlier charge sheets filed in this case, had named actor Jacqueline Fernandez as an accused while Fatehi's statement was included in the same prosecution complaint.

In a statement, Fatehi had told the agency that Chandrashekar's wife Leena Maria Paul (Leena Paulose) had invited her to a charity event at a five-star hotel in Chennai in December 2020 and was offered a new iPhone, a Gucci bag and a BMW car.

"I had received the bag and phone on the spot in front of everyone but the procedure to gift the car was done after the event," she had told the ED.

Fatehi added the car was given to her brother-in-law who sold it in February 2021 due to "some financial issues."

"I did not receive anything else besides the items mentioned above (Gucci bag and mobile phone). Also, the BMW was not given to me, it was given to Bobby (cousin's husband) instead," Fatehi told the agency.

Asked if she purchased any bag from a Mumbai mall, the payment for which was "arranged" by Chandrashekhar, the dancer denied the charge and said in her statement: "No HELL No."

The agency has alleged that Chandrashekhar, 32, used illegal money to purchase gifts for Fernandez which he had extorted by cheating high-profile people including former Fortis Healthcare promoter Shivinder Mohan Singh's wife Aditi Singh to the tune of about Rs 200 crore.

Chandrashekhar and his wife Paul were arrested by the ED.

The ED had said in a statement that Chandrashekhar is a "known conman" and is being probed by the Delhi Police in a case of alleged criminal conspiracy, cheating and extortion to the tune of about Rs 200 crore.

"Chandrasekhar is the mastermind of this fraud. He has been part of the crime world since the age of 17. He has multiple FIRs against him...," the ED had said.

Despite being in jail, it said, Chandrashekhar "did not stop conning" people.

"He (using a cellphone procured illegally in prison) with the help of technology made spoofed calls to dupe people as the numbers displayed on the called party's phone number belonged to senior government officers.

"While speaking (from prison) to these persons, he claimed to be a government officer offering to help people for a price," the ED had claimed.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Mumbai, Aug 13 (PTI): Stock markets rebounded on Wednesday with benchmark Sensex closing higher by 304 points on buying in metal, auto and pharma shares as steady US inflation data propelled a sharp rally in global markets.

The 30-share BSE Sensex climbed 304.32 points or 0.38 per cent to settle at 80,539.91. During the day, it jumped 448.15 points or 0.55 per cent to 80,683.74.

The 50-share NSE Nifty edged up by 131.95 points or 0.54 per cent to 24,619.35.

Analysts said retail inflation slowing to an 8-year low of 1.55 per cent in July led to the positive trend in domestic equities.

"Indian equities experienced a broad-based optimism as CPI hit an eight-year low, boosting hopes for a revival in discretionary spending, led by autos and metals. Globally, sentiment improved on the extension of China’s tariff deadline and easing oil prices.

"Despite uncertainties around Trump’s trade stance and global risks, India’s growth-inflation dynamics remain favourable for FY26 with risk to marginal downgrade based on tariff updates. India looks forward to the Trump-Putin meet dated 15th August," Vinod Nair, Head of Research, Geojit Investments Limited, said.

Among Sensex firms, Bharat Electronics, Eternal, Mahindra & Mahindra, Kotak Mahindra Bank, Tata Motors and Power Grid were the gainers.

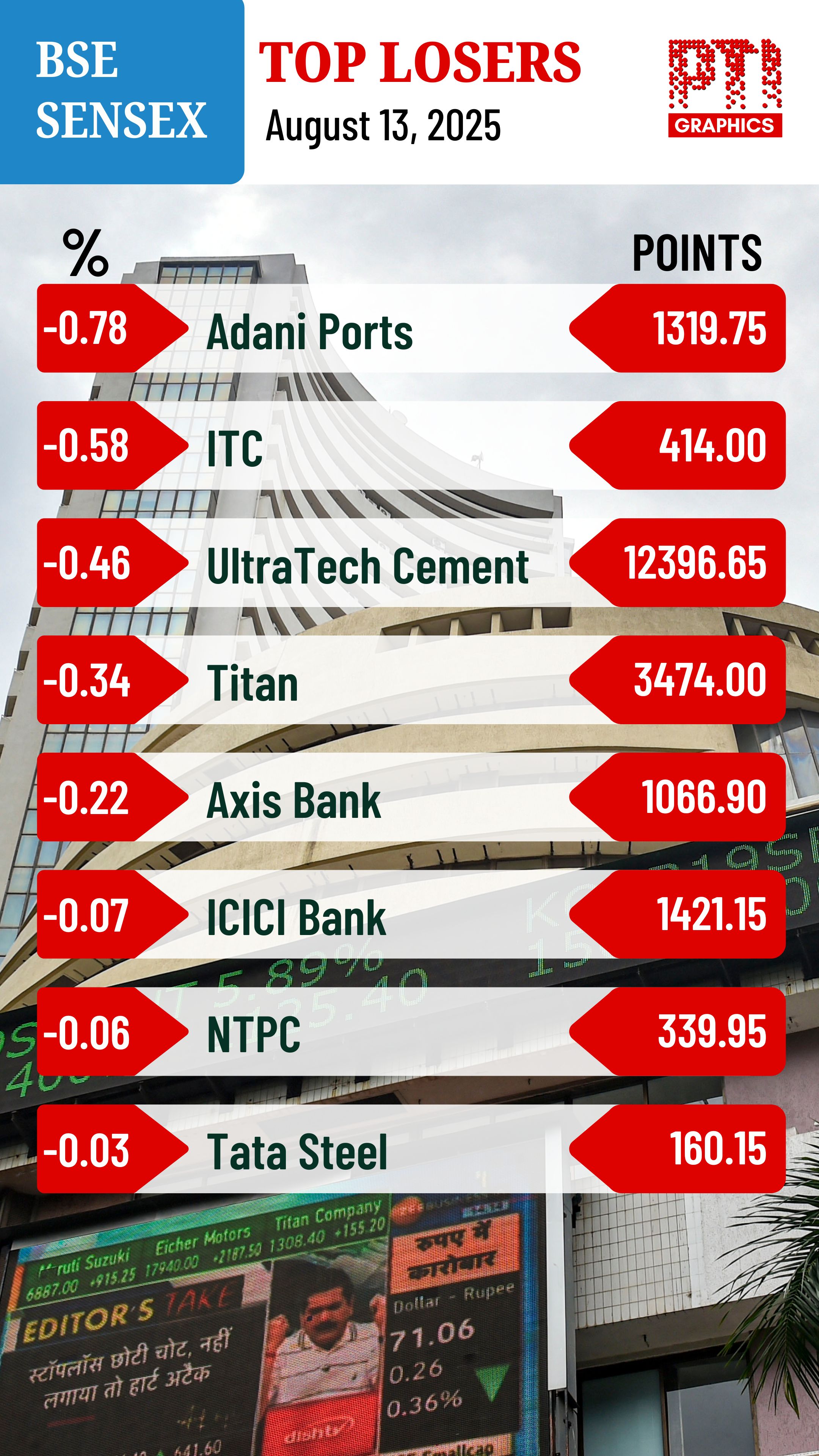

However, Adani Ports, ITC, UltraTech Cement and Titan were among the laggards.

Retail inflation slowed to an 8-year low of 1.55 per cent in July, falling below the Reserve Bank's comfort zone for the first time since January 2019, helped by subdued prices of food items, according to government data released on Tuesday.

"Indian equities advanced on Wednesday, buoyed by easing domestic retail inflation, positive global cues, and renewed hopes of a US Federal Reserve rate cut, Gaurav Garg, Analyst, Lemonn Markets Desk, said.

The BSE smallcap gauge climbed 0.58 per cent and midcap index went up by 0.56 per cent.

Among BSE sectoral indices, healthcare jumped 1.76 per cent, metal (1.22 per cent), auto (1.18 per cent), consumer discretionary (0.96 per cent), industrials (0.70 per cent) and financial services (0.45 per cent).

Oil & Gas and FMCG were the laggards.

Shares of Apollo Hospitals Enterprise Ltd spurted by nearly 8 per cent, emerging as lead gainer among Nifty50 shares after the healthcare services provider reported a 42 per cent jump in profit after tax to Rs 433 crore in the June quarter.

Paytm shares closed higher by 3 per cent as Paytm Payments Services received the Reserve Bank of India's nod to operate as an online payment aggregator.

As many as 2,230 stocks advanced while 1,861 declined and 155 remained unchanged on the BSE.

Among Asian markets, South Korea's Kospi, Japan's Nikkei 225 index, Shanghai's SSE Composite index and Hong Kong's Hang Seng settled sharply higher. European markets were trading in the green.

The US markets ended significantly higher on Tuesday.

Global oil benchmark Brent crude dipped 0.36 per cent to USD 65.88 a barrel.

Foreign Institutional Investors (FIIs) offloaded equities worth Rs 3,398.80 crore on Tuesday, according to exchange data. Sensex dropped 368.49 points or 0.46 per cent to settle at 80,235.59 while Nifty went lower by 97.65 points or 0.40 per cent to 24,487.40 on Tuesday.