New Delhi, Sep 3 : With monthly transactions crossing 300 million mark through Unified Payments Interface (UPI), Finance Ministry officials on Monday said digital payment will soon be the norm in the country.

"Digitalisation of payments in India is marching ahead with gusto. With base of 100 million Indians connected with digital payment ecosystem rising at a fast clip, India will soon be a digital payment society," Economic Affairs Secretary Subhash Chandra Garg on Monday said in a tweet.

UPI, the real-time bank-to-bank payment system on mobile platform launched in 2016, registered 312.02 million transactions in August, up 32 per cent from 235.65 million transactions in July, the National Payments Corporation of India (NPCI) said on Saturday.

In terms of transaction value, the money transferred through India's flagship payments platform went up 18 per cent to Rs 54,212.26 crore in August from Rs 45,845.64 crore in July, said the NPCI, which developed the platform, in its monthly update on UPI.

The data does not include transactions with debit or credit in the same account for the month of August, it said. It had directed banks to stop transactions from different UPI applications with debit and credit happening in the same account from August 1 to prevent artificial transactions by fintech companies to increase UPI numbers.

Financial Services Secretary Rajeev Kumar said the spurt in digital transactions reflects changing consumer behaviour and wider adoption of the technology in society.

"Digital India making deep inroads into consumer behaviour. BHIM UPI txns show increasing user adoption month on month. Aug '18 txn count/value up by 32.7% & 18% over July '18. Building a less-cash and financially-inclusive economy," Kumar tweeted.

In a year's time, the number of banks attached to UPI has gone up from 55 in August 2017 to 114 in August 2018. Year-on-year, the volume of transactions shot up 19 times from 16.6 million in August 2017 to 312 million last month, the NPCI data revealed.

To make UPI more attractive, NPCI, which is owned by a consortium of major banks, launched UPI 2.0 last month that allows banks to introduce more facilities like linking customers' overdraft accounts with UPI and checking invoice before payment.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

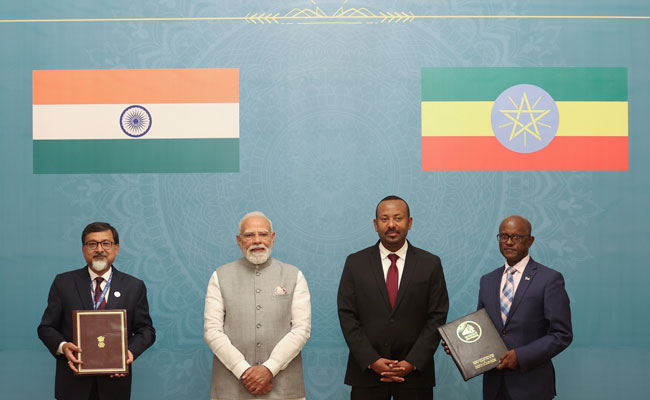

Addis Ababa (PTI): India and Ethiopia on Tuesday elevated their historical ties to a strategic partnership, as Prime Minister Narendra Modi held wide-ranging talks with his Ethiopian counterpart Abiy Ahmed Ali during which they discussed issues of bilateral and mutual interest.

Modi, who arrived here from Jordan on his maiden bilateral visit, was accorded a ceremonial welcome at the National Palace ahead of the bilateral talks, reflecting the vibrant India-Ethiopia relations rooted in shared history and a promising future.

"We are elevating India and Ethiopia relations to a strategic partnership. This step will provide new energy, new momentum and new depth to our ties," Prime Minister Modi said during the delegation-level talks.

He thanked PM Ali for his support in India's fight against terrorism. "The support of friendly countries in this struggle against terrorism holds great significance," Modi said.

"Today, we got the opportunity to deliberate on the key aspects of our cooperation, such as economy, innovation, technology, defence, health, capacity-building and multilateral cooperation. I am pleased that today, we have decided to double the student scholarship for Ethiopia in India," Modi said.

Modi said that India and Ethiopia have shared contact, dialogue, and exchange for thousands of years. The two countries, which are rich in languages and traditions, are symbols of unity in diversity, he added.

"Both countries are democratic powers committed to peace and the welfare of humanity. We are co-travellers and partners of the Global South. On international platforms, we have stood shoulder-to-shoulder," he said.

The two sides signed eight MoUs/agreements, including upgrading ties to 'Strategic Partnership', customs cooperation, establishing data center at the Ethiopian Foreign Ministry, UN Peacekeeping training cooperation, debt restructuring under G20, more ICCR scholarships and AI short courses for Ethiopians, and support for maternal and neonatal healthcare.

Modi said the African Union's headquarters in Ethiopia makes the country a meeting point of African diplomacy. "Inspired by the common vision of an inclusive world, in 2023, India ensured that the African Union became a G20 member," he said.

In 2023, during India’s G20 Presidency, the African Union was admitted as a permanent member of the G20.

Modi said that though this is his first visit, he felt a deep sense of belonging and warmth, reflecting the thousands of years of connection between the two countries.

On his part, Prime Minister Ali said the two countries share over thousands of years of connection through trade, diplomacy, education, culture and even in our food and traditions. "These ties continue to shape a deep friendship, collaboration and mutual respect between our people," he said.

"We also appreciate your consistent message that Africa's priorities must lead the partnership. These kinds of dignified, respectful messages for Africa are very important. Mr Prime Minister, keep pushing. That is the type of message we are expecting from all our trusted friends," Ali said.

He said this aligned fully with Ethiopia's development plan - African-owned, African-led, and African-defined.

"Today, we meet with a clear focus to shape a modern partnership, grounded in sovereignty, self-reliance and practical cooperation. Our cooperation is rooted in equality and South-South solidarity," he said.

"Our economy is performing strongly. Last year, we grew 9.2% and this year we are expecting 10.3% GDP growth. Besides GDP growth, our FDI inflow is also rising big time. India is the leading source for our FDI," he said.

"We have more than 615 Indian companies which are investing in Ethiopia. This all gives our cooperation a strong foundation of trust. I think our decision today that we elevate our historic relationship to a strategic relationship is the right decision," he added.

Ethiopia also conferred its highest award - The Great Honour Nishan of Ethiopia - on PM Modi. He is the first global head of state to receive this award.

Prime Minister Modi also went to the Friendship Park and Friendship Square in Addis Ababa with PM Ali.

In a warm and special gesture, PM Modi was earlier received by his Ethiopian counterpart at the airport and accorded a warm and colourful welcome.

"Ethiopia is a nation with great history and vibrant culture," Modi said.

PM Ali informed his Indian counterpart about the varieties of Ethiopian coffee during informal talks.

"At Addis Ababa airport, took part in a traditional Coffee Ceremony with Prime Minister Abiy Ahmed Ali. The ceremony beautifully highlights Ethiopia’s rich heritage," Modi said.

In a unique gesture, the Ethiopian Prime Minister drove Modi to the hotel.

On the way, he took a special initiative of taking PM Modi to the Science Museum and Friendship Park, which was not in the itinerary.

"Gratitude to Prime Minister Abiy Ahmed Ali for showing me glimpses of Ethiopian history and culture at the National Palace Museum in Addis Ababa. It was a powerful reminder of Ethiopia’s rich traditions," Modi said in a post on X.

The Nobel Peace Prize-winning Ethiopian PM’s special gestures show remarkable respect for Modi, sources said.

"Thank you Ethiopia for a welcome that was unforgettable. The Indian community showed remarkable warmth and affection. India-Ethiopia friendship is going to get even more robust in the times to come," Modi said.

When Modi arrived at the hotel, he was warmly welcomed by the members of the Indian community. Local artists performed dances. Some of them danced on the theme of the popular Hindi song 'Aisa Des Hai Mera' to welcome him.

On Wednesday, Modi will address the Joint Session of Parliament and share his thoughts on India's journey as the "Mother of Democracy" and the value that the India-Ethiopia partnership can bring to the Global South.

PM Modi arrived in Ethiopia from Jordan, where he held a one-on-one meeting with King Abdullah II at the Husseiniya Palace on Monday before the delegation-level talks.

India and Jordan also inked MoUs in the fields of culture, renewable energy, water management, digital public infrastructure and twinning arrangement between Petra and Ellora, aimed at giving a major boost to bilateral ties and friendship.

From Ethiopia, Modi will visit Oman on the final leg of this three-nation tour.