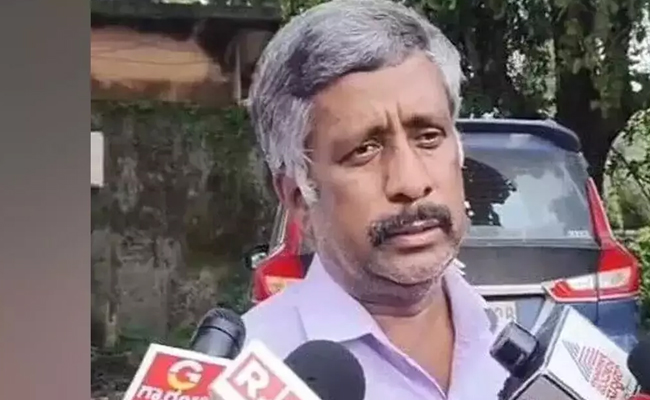

Imphal (PTI): Manipur Congress president Keisham Meghachandra Singh on Friday said the involvement of the RSS will solve the crisis in the state, as it requires a government-led political solution and confidence-building measures.

Reacting to the three-day tour of RSS chief Mohan Bhagwat, he said any visit that "prioritises strengthening organisational growth" over the suffering of the people sends a wrong message.

"The Manipur Pradesh Congress Committee takes note of the visit of RSS Sarsanghchalak Mohan Bhagwat to Manipur. At a time when Manipur is still suffering from unprecedented violence, displacement, social division, and administrative collapse, the people expected the Central Government to send a concrete plan for peace and restoration of normalcy," he said in a post on X.

"However, instead of addressing the humanitarian crisis and the breakdown of governance, the visit appears to be focused primarily on strengthening RSS organisational activities in the State," he added.

Claiming that RSS involvement will not solve the crisis, Singh said the ongoing turmoil requires a government-led political solution, administrative accountability, and confidence-building measures.

"Strengthening ideological organisations will not bring peace," he added.

The Congress leader said if the Centre was serious about solving the ethnic crisis in the state, it should provide a concrete roadmap for peace, a unified command structure, a plan for the safe return of displaced families, and accountability for administrative failures.

"MPCC reiterates that the focus must remain on restoration of normalcy, protection of all communities, and justice for victims. Political or ideological visits cannot substitute real governance," he said.

"Manipur needs healing, not polarisation. Any visit that prioritises organisational growth over people’s suffering sends a wrong message at this critical time," he added.

Bhagwat reached Imphal on Thursday, his first visit since ethnic violence broke out in the state in May 2023.

During his stay, Bhagwat will hold a series of closed-door interactions with RSS members to oversee the functioning of the organisation in the northeastern state.

He will also interact with entrepreneurs, tribal leaders from the Manipur hills, prominent citizens and leaders of youth organisations in the state.

Manipur has been under the President's Rule since February after CM N Biren Singh, who led a BJP government, resigned amid criticism of his administration's handling of the ethnic violence, which has claimed over 260 lives.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Kolkata (PTI): Alleging that her West Bengal counterpart Mamata Banerjee had approached the Supreme Court to stall the SIR exercise to prevent the identification of infiltrators, Delhi Chief Minister Rekha Gupta on Sunday claimed that the people of the state have made up their minds to dislodge the Trinamool Congress from power.

The TMC countered strongly, urging Gupta to "look into her own backyard" and accused her of making absurd allegations against the TMC government without checking facts.

Addressing participants at the 'Nari Sankalp Yatra' organised by the BJP's women's wing at Science City auditorium here, Gupta alleged that the "hands-off" and appeasement policies of the TMC government had allowed thousands of infiltrators to enter the state in recent years.

She claimed that this had put a strain on basic rights such as access to water, electricity, ration, education, livelihood and the right to vote for genuine citizens.

"She wants to perpetuate this and hence is trying to stall the SIR exercise, which aims at identifying and deporting infiltrators. Imagine a chief minister going to the apex court to argue against an exercise meant to ensure free and fair polls," Gupta said.

The BJP leader alleged that appeasement politics had reached an "alarming level" under the TMC regime.

Raising concerns over women's safety, she claimed that women in the state were not secure despite having a woman chief minister.

Referring to the rape-murder of a woman doctor at RG Kar Hospital, Gupta alleged that the state government had failed to respond adequately to such crimes.

She also referred to the alleged rape of a woman medic in Durgapur and another law student on a Kolkata college campus, claiming that criminals had been emboldened to commit brutalities against women.

She alleged that in crimes against women, overall crime incidents and child marriages, West Bengal remained among the top -- "a slur on a state which once led intellectual and social movements and set examples for the rest of the country," she said.

Criticising the state government's welfare initiatives, she said schemes such as Kanyashree were built on "false claims" and asserted that women needed security rather than assurances.

Accusing the state government of blocking central schemes, Gupta alleged that funds worth "lakhs of crores of rupees" had not reached the poor due to non-implementation of programmes such as Ayushman Bharat, PM Awas Yojana and Jal Jeevan Mission by the state.

"You are only interested in renaming projects and taking credit," she said.

Gupta also alleged that the education sector in the state had been adversely affected, saying several state-run schools had closed due to a shortage of teachers and that the government was opposed to the National Education Policy.

Drawing a comparison with BJP-ruled Delhi, Gupta said, "People have already voted out 'Bhaia' (a reference to former Delhi chief minister Arvind Kejriwal). Now it is your turn to bid farewell to 'Didi'." Calling upon women to resist what she termed "strong-arm tactics", she urged them to assert their strength, invoking the imagery of Goddess Durga.

"Bengal has the right to live with dignity, and women have the right to live with dignity," she added.

Reacting to Gupta's allegations, West Bengal Women and Child Welfare minister Shashi Panja accused her of making "absurd allegations" against the Trinamool Congress government ahead of elections.

Panja alleged that during Gupta's tenure in Delhi, several incidents had raised serious concerns, including reports of missing young women and a blast near the Red Fort.

She also criticised the air pollution situation in the national capital, claiming that people were struggling to breathe.

The TMC leader said that despite being in power for a year, Gupta was making "tall claims" instead of addressing key issues in Delhi.

Panja further alleged that the Delhi CM visited West Bengal during elections to "peddle false allegations" against the state government.

Rebutting Gupta, the TMC said in a post on X said, "Madam why did you go off-script again? For your edification, here are the cold, hard facts: In total cases of crimes (IPC + SLL), Bengal ranks a respectable 15th, far safer than BJP-ruled Uttar Pradesh, Maharashtra, and Gujarat, which languish near the bottom."

"In overall crime rate, Bengal sits comfortably at 28th. Who's second? Your own Delhi. Double Engine Gujarat and Haryana grab 4th and 5th as top-tier crime havens," the TMC said.

"In child marriage, Assam again takes the shameful pole position. And yet you dare lecture Bengal? Stop embarrassing yourself, stop the hypocrisy, and maybe fix the rotting mess in your own backyard before pointing fingers at a state that's outperforming your disasters on every key metric," the TMC countered.