Mangaluru: MCC Bank Ltd marked its 113th Founder's Day with a vibrant celebration at its Administrative Office Campus on Saturday, honoring the enduring legacy of its founder, P.F.X. Saldanha, and reaffirming the Bank’s steadfast commitment and resilience in the cooperative sector.

The program began with a prayer conducted by Deale Dsouza and team. Documentary on the history and progress of the bank was presented. Distinguished guests on the dais included Rev. Fr Denis D’Sa, PRO, Udupi Diocese; Rev. Sr Clara Menezes, UFC, Provincial Superior, Mangalore Province; Lionel Aranha, Chartered Accountant; Prof. Hilda Rayappan, Director, Prajna Counselling Centre; Stephen Menezes, President, Mangalore Konkans, Dubai and Sunil Menezes, General Manager of the Bank.

In his welcome address, Anil Lobo, Chairman of the Bank, extended a warm greeting to the dignitaries, board members, staff, and guests present. He highlighted the remarkable transformation of MCC Bank over the years, emphasizing its current standing on par with nationalized banks in terms of service quality and performance. Lobo expressed heartfelt admiration for Rev. Fr Denis D’Sa, describing him as a true source of inspiration and a paragon of professionalism. He modestly chose not to elaborate on the Bank’s achievements, noting that they had already been effectively conveyed to the audience.

The program included a tribute to the Bank’s founder, as dignitaries and member of P.F.X. Saldanha’s family offered floral respects to his portrait.

In his keynote address, Rev. Fr Denis D’Sa congratulated the Bank and delivered an inspiring message rooted in three core principles:

1. Looking Back with Gratitude – Celebrating the legacy and foundational values of the institution.

2. Looking Within for Self-Evaluation – Encouraging introspection through SWOT analysis and the courage to take risks.

3. Looking Forward with Trust in God – Emphasizing faith and perseverance, drawing parallels with astronaut Sunita Williams' journey.

He urged the staff members to remain diligent, serve with empathy, and approach customers with a smile.

Charity contributions were distributed by the Chairman to De Mercede Orphanage, Panir, and Shalom Trust®️, Kankanady, underlining the Bank’s commitment to

social responsibility.

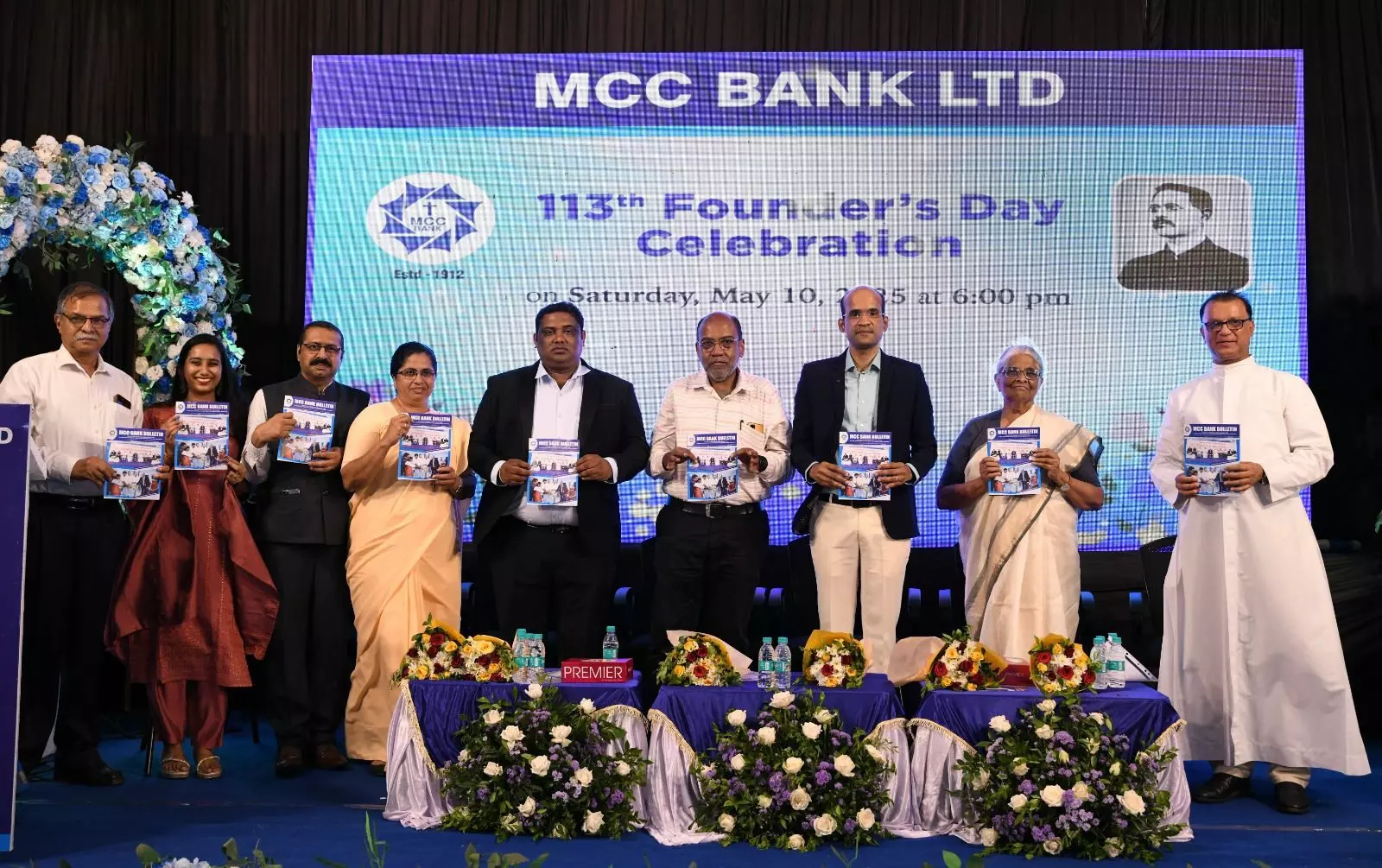

Rev. Sr Clara Menezes released the annual bulletin, joined by Editor Dr Gerald Pinto and Sub-Editor Shery Ashna. In her address, she praised the Bank’s legacy and emphasized the importance of opportunity, patience, professionalism, and hard work in achieving sustainable growth. Newly qualified Chartered Accountants, children of esteemed customers were felicitated.

Prof. Dr Edmund J. B. Frank, St Aloysius college and Ex-chairman of MCC bank, Mr Marcel M. Dsouza, Ex Director of MCC Bank, Konkani Writer and Mr Stephen Menezes, newly elected President of Mangalore Konkans, Dubai, for their commendable service to the community were also felicitated.

CA Lionel Aranha presented a brief history of the Bank, reminding attendees that success is not merely about results, but about the integrity and principles upheld in achieving them.Additionally, Prof Hilda Rayappan, Director of Prajna Counselling Centre, who has served the Society for the last 50 years was also felicitated during the occasion.

Directors Andrew Dsouza, Herold Monteiro, Anil Patrao, Roshan Dsouza, Melwyn Vas, Freeda Dsouza, Irene Rebello, Alwyn P. Montiero, Sharmila Menezes, Felix DCruz, Dr Gerald Pinto, and C G Pinto were present.

The event was presided over by Sahakara Ratna Anil Lobo, Chairman of the Bank, with General Manager Sunil Menezes delivering the vote of thanks, and Grishma Melisha Saldanha of Neermarga serving as the compère.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Kolkata (PTI): Former railway minister Mukul Roy, once regarded as West Bengal Chief Minister Mamata Banerjee's most trusted lieutenant and the TMC's principal strategist, died of cardiac arrest at a private hospital here early on Monday.

He was 71, and is survived by his son, Subhranshu Roy.

He breathed his last around 1.30 am at the hospital in Salt Lake, Subhranshu Roy said.

He had been suffering from multiple ailments and was in and out of the hospital over the past two years. Family members said he had also been diagnosed with dementia and had recently gone into a coma.

His body will be taken to his residence before the last rites are performed later in the day, they said.

A former Union minister and two-time Rajya Sabha member from West Bengal, Roy's four-decade-long political journey saw his stints in the Congress, TMC and the BJP.

His political career began with the Youth Congress, before he joined hands with Banerjee when she broke away from the grand old party to form the Trinamool Congress in 1998.

As a founding member, he quickly emerged as one of the key organisational pillars of the fledgling party and went on to serve as its general secretary.

He was elected to the Rajya Sabha in 2006 and became the party's leader in the Upper House in 2009, turning into TMC's principal troubleshooter in Delhi. In the UPA-2 government, when the TMC was a constituent, Roy first served as Minister of State for Shipping before taking over as the railway minister in 2012.

In West Bengal's political circles, Roy earned a reputation as a backroom operator deft in organisational work. Following the TMC's historic victory in 2011 that ended 34 years of the Left Front rule, he played a significant role in consolidating the party's hold in several districts, overseeing defections from the CPI(M) and the Congress, strengthening the new regime's political base.

However, his career was not without controversy. His name had surfaced in the Saradha chit fund case and the Narada sting operation.

By 2017, relations between Roy and the TMC leadership had deteriorated. In November that year, he joined the BJP in a move that altered the state's political equations. Tasked with strengthening the BJP's organisation in West Bengal, Roy was credited by party leaders with helping engineer defections from the TMC and expanding the saffron party's base ahead of the 2019 Lok Sabha polls, in which the BJP won 18 of the state's 42 seats.

He was elected as a BJP MLA from the Krishnanagar Uttar constituency in the 2021 West Bengal assembly elections. Within months, however, he returned to the TMC, triggering legal and political wrangling. Subsequently, a court disqualified him as an MLA under the anti-defection law for switching parties after being elected on a BJP ticket.

Though he rejoined the TMC, Roy never regained the political centrality he once enjoyed. As his health declined, he gradually withdrew from active politics.

Often described as the 'Chanakya' of West Bengal politics during his prime, Roy remained a pivotal figure in the state's turbulent political landscape -- a strategist who operated as comfortably in Delhi's power corridors as in the backrooms of Kolkata's party offices.

Leader of the opposition in the state assembly, Suvendu Adhikari, condoled Roy's death.

In an X post, he wrote, "Deeply disheartened to learn about the sad demise of senior politician, Shri Mukul Roy. My sincere condolences to his family. Praying that his soul attains eternal peace. Om Shanti."

_vb_47.jpeg)