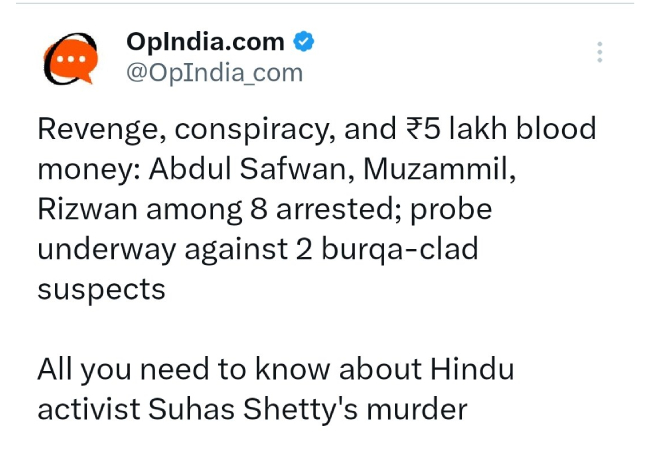

Mangaluru: Alt News co-founder Mohammed Zubair has accused right-wing website OpIndia of selectively naming only a few of the accused arrested in the murder case of rowdy-sheeter Suhas Shetty, while deliberately omitting the names of Hindu accused from their report.

In a tweet posted after police revealed the full list of those arrested, Zubair pointed out that OpIndia's tweet mentioned only Muslim names—Abdul Safwan, Mohammed Muzammil, and Mohammed Rizwan—while leaving out Ranjit and Nagaraj, who also face charges in the same case.

According to the police, a total of eight people have been arrested: Abdul Safwan, Niyaz, Mohammed Muzammil, Kalandar Shafi, Mohammed Rizwan, Adil Mahroof, Ranjit, and Nagaraj. Police Commissioner Anupam Agrawal has confirmed that the murder was a result of a personal rivalry and revenge plot. Safwan, the main accused, allegedly feared that Suhas Shetty's gang would kill him, prompting him to plan the murder.

Zubair alleged that by leaving out the names of Ranjit and Nagaraj—both of whom are non-Muslims—OpIndia was attempting to maintain a narrative that the murder was religiously motivated. This goes against the facts presented by police, which made it clear that the incident was not communal in nature but a gang-related revenge killing.

Earlier, several right-wing handles on social media had claimed that Suhas Shetty was targeted because of his religious identity, using the murder to attack the Congress-led state government and alleging that Hindus were unsafe in Karnataka. The BJP too had demanded an NIA probe, calling the murder an act of terror carried out by "Jihadis."

RW propaganda website @OpIndia_com intentionally doesn't mention names of other accused arrested after the murder of Rowdy-sheeter because the complete list of accused includes Ranjit & Nagaraj apart from Abdul Safwan, Niyaz, Mohammed Muzammil, Kalandar Shafi, Mohammed Rizwan,… pic.twitter.com/JmdcaxtP2H

— Mohammed Zubair (@zoo_bear) May 3, 2025

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Gurugram (PTI): Days after a 19-year-old woman from Tripura was hospitalised in a serious condition following an assault by her live-in partner, police on Sunday said that the accused also burned her private parts using sanitiser and filmed her nude.

The woman’s mother alleged that the accused, who befriended her daughter online and had promised to marry her, confined her to a room for three days and even forced her to drink urine.

According to police, the woman’s condition is now stable.

The accused, Shivam (19), a resident of Delhi’s Narela, was arrested on Thursday based on an FIR registered against him at the Badshahpur police station.

The woman’s mother, a police officer in Tripura, claimed that on February 16, around 10 pm, she received a distress call from her daughter.

My daughter told me, "I don't have time, I will be killed... Shivam has been beating me and burning me for the last three days. He will kill me today."

The mother further alleged that the accused confined her daughter to a room for three days and tortured her. She also accused Shivam of forcing her daughter to drink urine and burning her private parts using sanatiser.

She said the accused also stabbed her daughter multiple times.

The mother then approached the Gurugram police, who rescued her daughter.

"My daughter is very bright in her studies. She had come to Gurugram to study. However, Shivam lured her into a trap through an online app. My daughter's condition is very serious,” she said, adding that strict action should be taken against the accused.

Earlier, police said that Shivam had allegedly established physical relations with the woman who is a college student, promising her marriage.

The couple had been living together in a paying guest accommodation in Sector 69 for the last few months. During this period, he allegedly began assaulting her after suspecting her of cheating.

A Gurugram Police spokesperson said the case has been marked for close monitoring.

“Charges of rape and assault have already been added to the FIR, and the accused has been sent to jail. Further investigation is underway,” he said.

The spokesperson added that the woman’s condition is now stable.

Police had said that on February 19, the couple had an altercation after which the accused assaulted the woman, severely injuring her. Upon receiving a call from her mother police reached the flat and rescued her.

The accused allegedly attacked the victim in a fit of rage, suspecting her of cheating on him, police had said.

The woman was initially admitted to AIIMS-Delhi and is currently undergoing treatment at Safdarjung Hospital in Delhi, police said.