Mangaluru, Apr 18: Karnataka Yakshagana Academy president, scholar and author M A Hegde died in Bengaluru early on Sunday.

He was 73.

Hegde is survived by wife, son and a daughter.

Hegde breathed his last while being taken to a hospital in the morning after developing breathing difficulties caused by coronavirus infection.

He was diagnosed with Covid-19 infection on April 13 and was in home isolation, sources said.

Hegde, who was a gifted Yakshagana stage artiste, had written over 15 Yakshagana prasangas (scripts) including 'Dharma Durantha', 'Seetha Viyoga', 'Jagruti',' Trishanku Charitre' and 'Sabarimale Ayyappan.'

He had also written books on the issues of Alankara Tatwa, Indian philosophy and Brahmasutra.

He was a Sanskrit scholar and had edited Yakshagana prasanga 'Aadi Parva.'

Hegde also served as a lecturer in Kadasiddeshwara Arts College and PP Jabin College, Hubballi.

He had also served in the capacity of Sanskrit lecturer later.

He was a native of Mandikoppa near Siddapura in Uttara Kannada district and retired as the principal of a college in Siddapura.

His last public programme was a Yakshagana workshop held at the St. Aloysius College here on April 10.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Judge cites denial of home to Muslim girl, opposition to Dalit women cooking mid-day meals

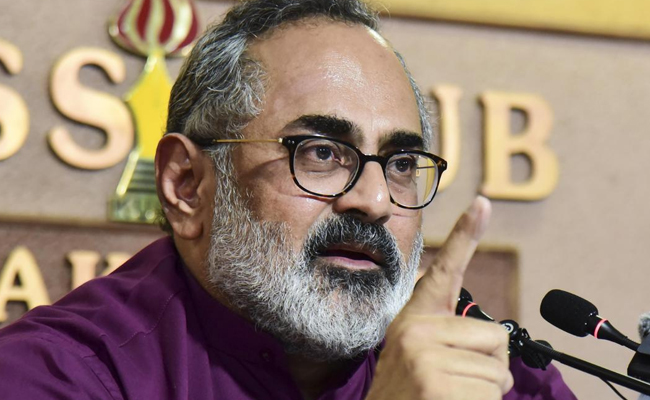

Hyderabad, February 23, 2026: Supreme Court judge Justice Ujjal Bhuyan has said that despite repeated affirmations of constitutional morality by courts, deep societal faultlines rooted in caste and religious discrimination continue to shape everyday realities in India.

Speaking at a seminar on “Constitutional Morality and the Role of District Judiciary” organised by the Telangana Judges Association and the Telangana State Judicial Academy in Hyderabad, Justice Bhuyan reflected on the gap between constitutional ideals and social practices.

He cited a recent instance involving his daughter’s friend, a PhD scholar at a private university in Noida, who was denied accommodation in South Delhi after her surname revealed her Muslim identity. According to Justice Bhuyan, the landlady bluntly informed her that no accommodation was available once her religious background became known.

In another example from Odisha, he referred to resistance by some parents to the government’s mid-day meal programme because the food was prepared by Dalit women employed as cooks. He noted that some parents had objected aggressively and refused to allow their children to consume meals cooked by members of the Scheduled Caste community.

Describing these incidents as “the tip of the iceberg,” Justice Bhuyan said they reveal how far society remains from the benchmark of constitutional morality even 75 years into the Republic. He observed that while the Constitution lays down standards of equality and dignity, the morality practised within homes and communities often diverges sharply from those values.

He emphasised that constitutional morality requires governance through the rule of law rather than the rule of popular opinion. Referring to the evolution of the doctrine through judicial decisions, he cited Naz Foundation v Union of India, in which the Delhi High Court read down Section 377 of the Indian Penal Code, holding that popular morality cannot restrict fundamental rights under Article 21. Though the judgment was later overturned in Suresh Kumar Koushal v Naz Foundation, the Supreme Court ultimately restored and expanded the principle in Navtej Singh Johar v Union of India, affirming that constitutional morality must prevail over majoritarian views.

“In our constitutional scheme, it is the constitutionality of the issue before the court that is relevant, not the dominant or popular view,” he said.

Justice Bhuyan also addressed the functioning of the district judiciary, underlining that trial courts are the first point of contact for most litigants and form the foundation of the justice delivery system. He stressed that due importance must be given to the recording of evidence and adjudication of bail matters.

Highlighting the role of High Courts, he said their supervisory jurisdiction under Article 227 of the Constitution is intended as a shield to correct grave jurisdictional errors, not as a mechanism to substitute the discretion or factual appreciation of trial judges.

He recalled that several distinguished judges, including Justice H R Khanna, Justice A M Ahmadi, and Justice Fathima Beevi, began their careers in the district judiciary.

On representation within the judicial system, Justice Bhuyan noted that Telangana has made significant strides in gender inclusion. Out of a sanctioned strength of 655 judicial officers in the Telangana Judicial Service, 478 are currently serving, of whom 283 are women, exceeding 50 per cent representation. He added that members of Scheduled Castes, Scheduled Tribes, minority communities, and persons with disabilities are also represented in the state’s judiciary.

He observed that greater representation of women, marginalised communities, persons with disabilities, and sexual minorities would help make the judiciary more inclusive and reflective of India’s diversity. “The judiciary must represent all the colours of the rainbow and become a rainbow institution,” he said.

Justice Bhuyan also referred to the recent restoration by the Supreme Court of the requirement of a minimum three years of practice at the Bar for entry-level judicial posts. While acknowledging that the requirement ensures practical exposure, he cautioned that its impact on women aspirants, especially those from rural or small-town backgrounds facing social and financial constraints, would need to be carefully observed over time.

Concluding his address, he reiterated that the justice system must strive to bridge the gap between constitutional ideals and lived realities, ensuring that the rule of law remains paramount.