New Delhi, Aug 1: A day after it received Rs 32,403 crore GST demand, Infosys on Thursday said Karnataka state authorities have withdrawn the 'pre-show cause' notice to the company and directed it to submit further response to the Directorate General of GST Intelligence (DGGI) on the issue.

India's second largest IT company had made headlines on Wednesday after GST authorities slapped a Rs 32,403 crore notice on it for services availed by the company from its overseas branches for five years starting 2017.

The company had described the notice a 'pre-show cause' notice and categorically maintained that it believes that GST is not applicable on expenses mentioned.

ALSO READ: Karnataka govt. launches new cyber security policy

In a late evening filing on Thursday, Infosys informed: "The company has received a communication from Karnataka State authorities, withdrawing the pre-show cause notice and has directed the company to submit further response to DGGI central authority on this matter."

The Bengaluru-headquartered firm on Wednesday disclosed that Karnataka State GST authorities had issued a pre-show cause notice for payment of GST of Rs 32,403 crore for the period July 2017 to March 2022 towards the expenses incurred by overseas branch offices of Infosys Limited, and added that the company has responded to the notice.

"...the Company has also received a pre-show cause notice from Director General of GST Intelligence on the same matter and the Company is in the process of responding to the same," Infosys had said in the statutory filing on Wednesday.

The company believes that as per regulations, GST is not applicable on such expenses.

"Additionally, as per a recent Circular...issued by the Central Board of Indirect Taxes and Customs on the recommendations of the GST Council, services provided by the overseas branches to Indian entity are not subject to GST," Infosys had said.

Infosys had strongly argued that GST payments are eligible for credit or refund against export of IT services.

"Infosys has paid all its GST dues and is fully in compliance with the central and state regulations on this matter," the company had contended.

As per reports, the document sent to Infosys by GST authorities says: "In lieu of receipt of supplies from overseas branch offices, the Company has paid consideration to the branch offices in the form of overseas branch expense. Hence, M/s Infosys Ltd, Bengaluru is liable to pay IGST under reverse charge mechanism on supplies received from branches located outside India to the tune of Rs 32,403.46 crores for the period 2017-18 (July 2017 onwards) to 2021-22."

The demand -- a staggering Rs 32,403 crore -- is more than a year's profit for Infosys. For quarter just ended, Infosys' net profit rose 7.1 per cent year-on-year to Rs 6,368 crore, and revenue from operations stood at Rs 39,315 crore, an increase of 3.6 per cent from a year ago.

On Thursday, apex IT body Nasscom said the latest tax demand reflects a lack of understanding of the industry's operating model and sheds light on sector-wide issues wherein multiple companies are facing avoidable litigation and uncertainty.

In a detailed statement issued a day after Infosys' BSE filing on GST 'pre-show cause' notice, Nasscom asserted that government circulars issued based on recommendations of the GST Council must be honoured in enforcement mechanisms so that notices do not create uncertainty and negatively impact perceptions on India's ease of doing business.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

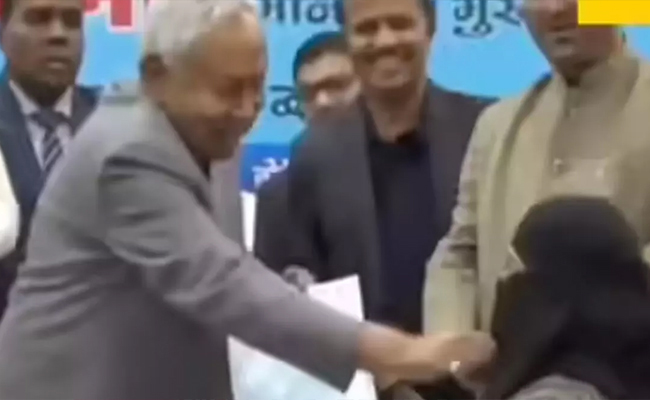

Srinagar (PTI): Jammu and Kashmir Chief Minister Omar Abdullah on Wednesday criticised his Bihar counterpart over the niqab incident and said that Nitish Kumar might be slowly revealing his true nature.

"Nitish Kumar, who was once considered a secular leader, may be slowly showing his true colours," Abdullah told reporters here on the sidelines of a function.

Abdullah said Kumar removing the face veil of a Muslim woman doctor was wrong and cannot be justified by any means.

"We have seen this kind of incident here several years ago. Have you forgotten how Mehbooba Mufti removed the burqa of a legitimate voter inside a polling station? That act was wrong, and this act (of Kumar) is also wrong.

"If the (Bihar) chief minister did not want to hand over the order to her (Muslim woman), they could have kept her aside. However, to humiliate her like this is totally wrong," the Jammu and Kashmir chief minister said.

Kumar stirred a huge controversy after he removed the face veil of a Muslim woman at a function earlier this week.