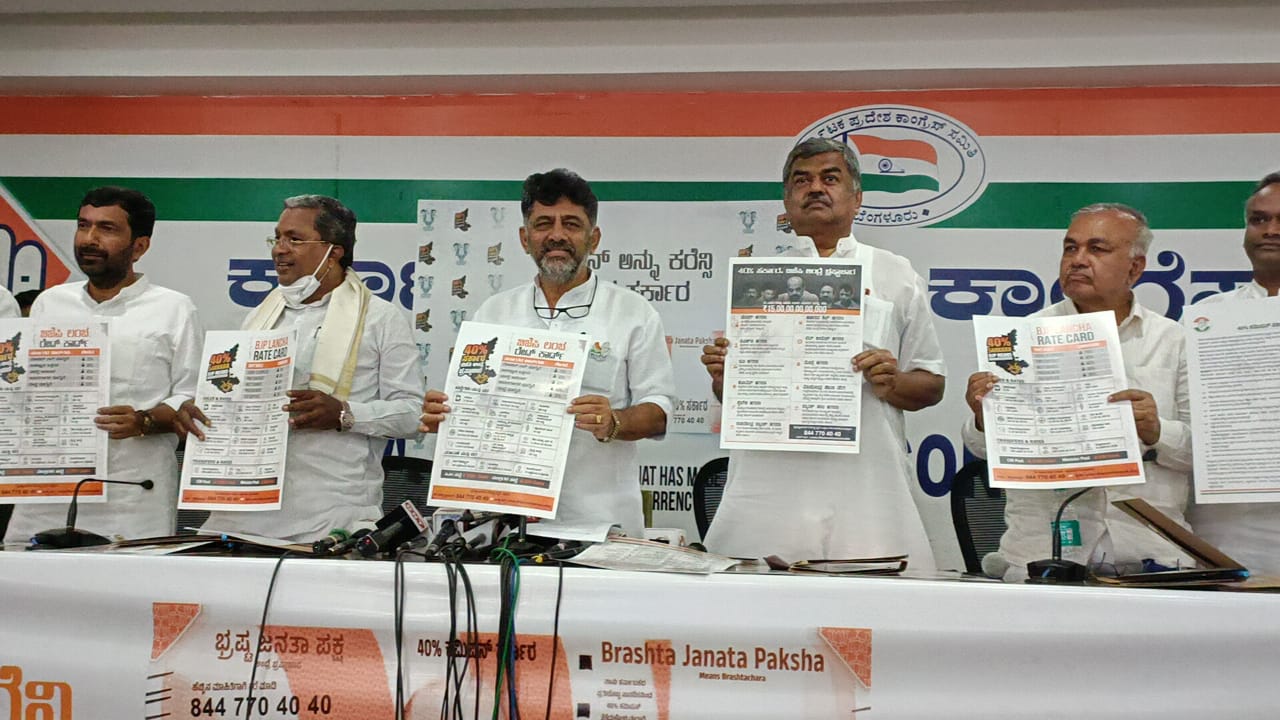

Bengaluru, Sept 13: Karnataka Congress on Tuesday launched a campaign against 40 per cent Sarkara, BJP means Bhrashtachara' with focus on the alleged corruption prevailing in Karnataka.

Today, we are launching a campaign against 40 per cent Sarkara, BJP means Bhrashtachara' (40 per cent government, BJP means corruption). Chief Minister Basavaraj Bommai knows that his Cabinet ministers are completely involved in corrupt activities and are looting, former Chief Minister and Congress leader Siddaramaiah said in a press conference.

He alleged that the public works have completely stopped.

Recalling the suicide of the Belagavi-based contractor and a BJP worker Santosh Patil who hanged himself in a hotel in Udupi earlier this year leaving behind a message holding the BJP's Shivamogga MLA K S Eshwarappa responsible for his death as he (MLA) allegedly demanded 40 per cent commission.

After the incident, Eshwarappa resigned as the Rural Development and Panchayat Raj Minister.

The Congress State president D K Shivakumar who was present at the press conference released a campaign song on the 40 per cent commission government'.

Later, in a statement, the Congress said, Karnataka is currently burdened by the bottomless greed of the BJP government. The 40 per cent Sarkara has made the words 'corruption' and 'commission' a mainstay in every aspect of governance. Their hunger for money is so much that they're happy to sacrifice the lives of innocent people as well. The party said it would not let the BJP run riot and destroy the lives of the people of Karnataka. It added that it would expose the BJP's failure.

40% ಸರ್ಕಾರದ ಭ್ರಷ್ಟಾಚಾರ ಬಯಲು ಮಾಡಲು ನಮ್ಮೊಂದಿಗೆ ಕೈಜೋಡಿಸಿ.

— Siddaramaiah (@siddaramaiah) September 13, 2022

844-770-40-40 ಗೆ ಕರೆ ಮಾಡಿ ಭ್ರಷ್ಟಾಚಾರದ ಬಗ್ಗೆ ದೂರು ನೀಡಿ https://t.co/QUNLHjlsWd ಗೆ ಭೇಟಿ ನೀಡಿ ನಿಮ್ಮ ದೂರನ್ನು ದಾಖಲು ಮಾಡಿ.

2023ರಲ್ಲಿ ಕಾಂಗ್ರೆಸ್ ಸರ್ಕಾರ ಈ ದೂರಿನ ಕುರಿತು ಕ್ರಮ ಕೈಗೊಳ್ಳಲಿದೆ.#40percentsarkara pic.twitter.com/YfKwxS4lXa

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

New Delhi: A bill to set up a 13-member body to regulate institutions of higher education was introduced in the Lok Sabha on Monday.

Union Education Minister Dharmendra Pradhan introduced the Viksit Bharat Shiksha Adhishthan Bill, which seeks to establish an overarching higher education commission along with three councils for regulation, accreditation, and ensuring academic standards for universities and higher education institutions in India.

Meanwhile, the move drew strong opposition, with members warning that it could weaken institutional autonomy and result in excessive centralisation of higher education in India.

The Viksit Bharat Shiksha Adhishthan Bill, 2025, earlier known as the Higher Education Council of India (HECI) Bill, has been introduced in line with the National Education Policy (NEP) 2020.

The proposed legislation seeks to merge three existing regulatory bodies, the University Grants Commission (UGC), the All India Council for Technical Education (AICTE), and the National Council for Teacher Education (NCTE), into a single unified body called the Viksit Bharat Shiksha Adhishthan.

At present, the UGC regulates non-technical higher education institutions, the AICTE oversees technical education, and the NCTE governs teacher education in India.

Under the proposed framework, the new commission will function through three separate councils responsible for regulation, accreditation, and the maintenance of academic standards across universities and higher education institutions in the country.

According to the Bill, the present challenges faced by higher educational institutions due to the multiplicity of regulators having non-harmonised regulatory approval protocols will be done away with.

The higher education commission, which will be headed by a chairperson appointed by the President of India, will cover all central universities and colleges under it, institutes of national importance functioning under the administrative purview of the Ministry of Education, including IITs, NITs, IISc, IISERs, IIMs, and IIITs.

At present, IITs and IIMs are not regulated by the University Grants Commission (UGC).

Government to refer bill to JPC; Oppn slams it

The government has expressed its willingness to refer it to a joint committee after several members of the Lok Sabha expressed strong opposition to the Bill, stating that they were not given time to study its provisions.

Responding to the opposition, Parliamentary Affairs Minister Kiren Rijiju said the government intends to refer the Bill to a Joint Parliamentary Committee (JPC) for detailed examination.

Congress Lok Sabha MP Manish Tewari warned that the Bill could result in “excessive centralisation” of higher education. He argued that the proposed law violates the constitutional division of legislative powers between the Union and the states.

According to him, the Bill goes beyond setting academic standards and intrudes into areas such as administration, affiliation, and the establishment and closure of university campuses. These matters, he said, fall under Entry 25 of the Concurrent List and Entry 32 of the State List, which cover the incorporation and regulation of state universities.

Tewari further stated that the Bill suffers from “excessive delegation of legislative power” to the proposed commission. He pointed out that crucial aspects such as accreditation frameworks, degree-granting powers, penalties, institutional autonomy, and even the supersession of institutions are left to be decided through rules, regulations, and executive directions. He argued that this amounts to a violation of established constitutional principles governing delegated legislation.

Under the Bill, the regulatory council will have the power to impose heavy penalties on higher education institutions for violating provisions of the Act or related rules. Penalties range from ₹10 lakh to ₹75 lakh for repeated violations, while establishing an institution without approval from the commission or the state government could attract a fine of up to ₹2 crore.

Concerns were also raised by members from southern states over the Hindi nomenclature of the Bill. N.K. Premachandran, an MP from the Revolutionary Socialist Party representing Kollam in Kerala, said even the name of the Bill was difficult to pronounce.

He pointed out that under Article 348 of the Constitution, the text of any Bill introduced in Parliament must be in English unless Parliament decides otherwise.

DMK MP T.M. Selvaganapathy also criticised the government for naming laws and schemes only in Hindi. He said the Constitution clearly mandates that the nomenclature of a Bill should be in English so that citizens across the country can understand its intent.

Congress MP S. Jothimani from Tamil Nadu’s Karur constituency described the Bill as another attempt to impose Hindi and termed it “an attack on federalism.”

_vb_22.jpeg)