Paris (PTI): Wrestler Antim Panghal, who caused embarrassment to the Indian Olympic contingent by trying to facilitate her sister's entry into the athletes village through her accreditation card, is likely to be banned for three years by the IOA, a source told PTI on Thursday.

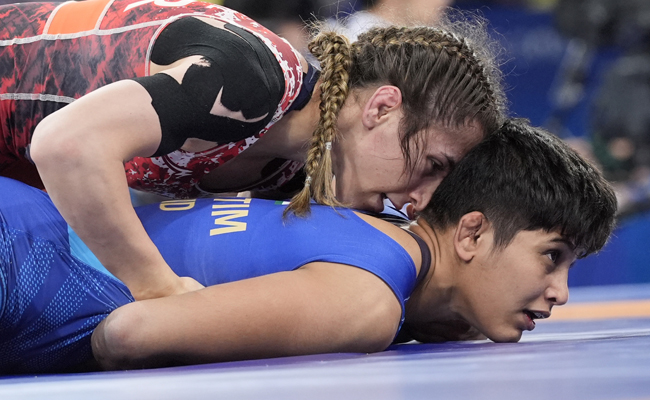

Panghal had crashed out of the Olympics after losing her opening bout in the women's 53kg category on Wednesday.

"IOA (Indian Olympic Association) officials discussed the issue that caused embarrassment to all. It is considering a three-year ban on everyone involved, including the coaches," a source in the Indian contingent told PTI.

"First, we need to ensure that she reaches home. The decision will be announced only after she reaches India," the source added.

Panghal is set to take a flight to Delhi this evening.

The IOA decided to send her and her support staff back after the disciplinary breach was brought to its notice by the French authorities.

The body, however, asserted that the ban has not yet been imposed.

"A ban has not been imposed as yet," said an IOA official.

Speaking with PTI before her flight back to India, the 19-year-old said, "I did not intend to do anything wrong. I was not well and there was confusion. All of this happened due to confusion."

Later, in a video, she admitted that she had to go to the police station but only for the verification of her accreditation card.

"It was not a good day for me. I lost. A lot is being spread about me, that's not true. I had high fever, and had taken permission from my coach to go to the hotel with my sister.

"I needed some some of my belongings which were in the Games Village. My sister took my card and asked the officials there if she could take my belongings. They took her to the Police Station for accreditation verification."

She also denied that her coaches were drunk and got into an altercation with a taxi driver over fare.

"My coaches had stayed back at the venue and when they wanted to come back, we booked a cab for them. My coaches did not have enough cash and due to the language issues, led to an argument with the taxi driver.

"Since they came to collect some Euros from the hotel room, it took some time and led to the situation. I already have had a bad time, please don't spread rumours. Please support me," she said.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Judge cites denial of home to Muslim girl, opposition to Dalit women cooking mid-day meals

Hyderabad, February 23, 2026: Supreme Court judge Justice Ujjal Bhuyan has said that despite repeated affirmations of constitutional morality by courts, deep societal faultlines rooted in caste and religious discrimination continue to shape everyday realities in India.

Speaking at a seminar on “Constitutional Morality and the Role of District Judiciary” organised by the Telangana Judges Association and the Telangana State Judicial Academy in Hyderabad, Justice Bhuyan reflected on the gap between constitutional ideals and social practices.

He cited a recent instance involving his daughter’s friend, a PhD scholar at a private university in Noida, who was denied accommodation in South Delhi after her surname revealed her Muslim identity. According to Justice Bhuyan, the landlady bluntly informed her that no accommodation was available once her religious background became known.

In another example from Odisha, he referred to resistance by some parents to the government’s mid-day meal programme because the food was prepared by Dalit women employed as cooks. He noted that some parents had objected aggressively and refused to allow their children to consume meals cooked by members of the Scheduled Caste community.

Describing these incidents as “the tip of the iceberg,” Justice Bhuyan said they reveal how far society remains from the benchmark of constitutional morality even 75 years into the Republic. He observed that while the Constitution lays down standards of equality and dignity, the morality practised within homes and communities often diverges sharply from those values.

He emphasised that constitutional morality requires governance through the rule of law rather than the rule of popular opinion. Referring to the evolution of the doctrine through judicial decisions, he cited Naz Foundation v Union of India, in which the Delhi High Court read down Section 377 of the Indian Penal Code, holding that popular morality cannot restrict fundamental rights under Article 21. Though the judgment was later overturned in Suresh Kumar Koushal v Naz Foundation, the Supreme Court ultimately restored and expanded the principle in Navtej Singh Johar v Union of India, affirming that constitutional morality must prevail over majoritarian views.

“In our constitutional scheme, it is the constitutionality of the issue before the court that is relevant, not the dominant or popular view,” he said.

Justice Bhuyan also addressed the functioning of the district judiciary, underlining that trial courts are the first point of contact for most litigants and form the foundation of the justice delivery system. He stressed that due importance must be given to the recording of evidence and adjudication of bail matters.

Highlighting the role of High Courts, he said their supervisory jurisdiction under Article 227 of the Constitution is intended as a shield to correct grave jurisdictional errors, not as a mechanism to substitute the discretion or factual appreciation of trial judges.

He recalled that several distinguished judges, including Justice H R Khanna, Justice A M Ahmadi, and Justice Fathima Beevi, began their careers in the district judiciary.

On representation within the judicial system, Justice Bhuyan noted that Telangana has made significant strides in gender inclusion. Out of a sanctioned strength of 655 judicial officers in the Telangana Judicial Service, 478 are currently serving, of whom 283 are women, exceeding 50 per cent representation. He added that members of Scheduled Castes, Scheduled Tribes, minority communities, and persons with disabilities are also represented in the state’s judiciary.

He observed that greater representation of women, marginalised communities, persons with disabilities, and sexual minorities would help make the judiciary more inclusive and reflective of India’s diversity. “The judiciary must represent all the colours of the rainbow and become a rainbow institution,” he said.

Justice Bhuyan also referred to the recent restoration by the Supreme Court of the requirement of a minimum three years of practice at the Bar for entry-level judicial posts. While acknowledging that the requirement ensures practical exposure, he cautioned that its impact on women aspirants, especially those from rural or small-town backgrounds facing social and financial constraints, would need to be carefully observed over time.

Concluding his address, he reiterated that the justice system must strive to bridge the gap between constitutional ideals and lived realities, ensuring that the rule of law remains paramount.