ZURICH/NEW DELHI: India has moved up to 73rd place in terms of money parked by its citizens and companies with Swiss banks, while the UK remains on the top.

India had slipped to 88th place with a 44 per cent plunge in such funds during 2016, but the latest data from the Swiss National Bank (SNB) shows an increase of over 50 per cent during 2017 to CHF 1.01 billion (about Rs 7,000 crore).

Pakistan is now placed one place higher than India at 72nd position, down one slot, after 21 per cent dips in funds from that country in Swiss banks during 2017.

The funds, described by SNB as 'liabilities' of Swiss banks or 'amounts due to' their clients, are official figures disclosed by Swiss authorities and do not indicate to the exact quantum of the much-debated alleged black money held in famed safe havens of Switzerland.

The official figures, disclosed annually by Switzerland's central bank, also do not include the money that Indians, NRIs or others might have in Swiss banks in the names of entities from different countries.

It has been often alleged that Indians and other nationals seeking to stash their illicit wealth abroad use multiple layers of various jurisdictions, including tax havens, to shift the money in Swiss banks.

Also, with Switzerland putting in place an automatic information exchange framework with India and various other countries, the famed secrecy walls of Swiss banks are said to have crumbled. India will start getting this automatic data from next year, while it has already been getting information on accounts where proof of illicit funds can be furnished.

However, the increase in Indians' money in Swiss banks has already triggered a sharp opposition attack on the government, which in turn has said that it would be wrong to assume that all funds deposited in Swiss banks were 'black money' and strong action would be taken against wrongdoers.

The funds officially held by Indians with banks in Switzerland now accounts for only 0.07 per cent, though up from 0.04 per cent a year ago, of the total funds kept by all foreign clients in the Swiss banking system, as per an analysis of the latest figures compiled by the SNB (Swiss National Bank) as on 2017-end.

India was placed at 75th position in 2015 and at 61st in the year before, though it used to be among top-50 countries in terms of holdings in Swiss banks till 2007. The country was ranked highest at 37th place in the year 2004.

The total money held in Swiss banks by foreign clients from across the world rose by about 3 per cent to CHF 1.46 trillion (about Rs 100 lakh crore) in 2017.

In terms of individual countries, the UK continued to account for the largest chunk at about CHF 403 billion (over 27 per cent) of the total foreign money with Swiss banks. The UK saw an increase of over 12 per cent in such funds.

The US remains on the second position despite a dip of about 6 per cent in such funds to CHF 166 billion (11 per cent share of all foreign funds). No other country accounted for a double-digit percentage share, while others in the top-ten included West Indies, France, Hong Kong, Bahamas, Germany, Guernsey, Luxembourg and Cayman Islands.

Among BRICS countries, India remains to rank the lowest -- China at 20th place (CHF 160 billion with an increase of 67 per cent during 2017), Russia at 23rd (CHF 135 billion after 13 per cent fall), Brazil 61st (CHF 1.9 billion after 28 per cent fall) and South Africa 67th (CHF 1.5 billion after 31 per cent dip). Among these five, only China and India saw an increase in their funds.

Others ranked higher than India are: Singapore, UAE, Saudi Arabia, Panama, Japan, Jersey, Australia, Netherlands, Italy, Belgium, Cyprus, Israel, Mexico, Bermuda, Turkey, Kuwait, Marshall Islands, Canada, Thailand, South Korea, Malaysia, Belize, Isle of Man, Indonesia, Seychelles, Gibraltar, Samoa, New Zealand, Philippines, Iran, Kazakhstan and Ukraine.

Those ranked below India were Mauritius (77th place), Bangladesh (95th), Sri Lanka (108th), Nepal (112th), Vatican City State (122nd), Iraq (132nd), Afghanistan (155th), Burkina Faso (162nd), Bhutan (203rd), North Korea (205th) and Palau was last at 214th place.

The total money belonging to the developed countries rose 10 per cent to CHF 876 billion, while those from developing nations rose marginally to CHF 209 billion. The offshore financial centres actually saw a dip of 3 per cent to CHF 378 billion.

India was ranked in top-50 continuously between 1996 and 2007, but started declining after that -- 55th in 2008, 59th in 2009 and 2010 each, 55th again in 2011, 71st in 2012 and then to 58th in 2013.

In terms of percentage increase, India's 50 per cent rise was 23rd highest. The maximum increase of as much as 4,000 per cent was seen by Solomon Islands, followed by over 2,200 per cent for Faroe Islands and 1,200 per cent for British Indian Ocean Territory.

The increase was more than 100 per cent for Maldives, Grenada, Turkmenistan, Laos, Lesotho, Qatar, Bonaire, Sint Eustatius and Saba, Federated States of Micronesia, Equatorial Guinea; and Sao Tome and Principe.

Others with higher increase than India's were Guyana, Mongolia, Barbados, Cote d'Ivoire, South Sudan, Bahrain, Kuwait and Ireland.

The jurisdictions that saw the maximum decline in such funds included Palau, St Helena and Gambia, while North Korea, Bhutan, Macao, Burkina Faso and Iraq also recorded significant dips.

courtesy : timesofindia.indiatimes.com

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

New Delhi (PTI): A day after a US submarine torpedoed and sank an Iranian warship in international waters off Sri Lanka's coast, the Congress on Thursday questioned the government's silence with Rahul Gandhi saying that while the country needed a steady hand at the wheel, it has a "compromised PM who has surrendered our strategic autonomy".

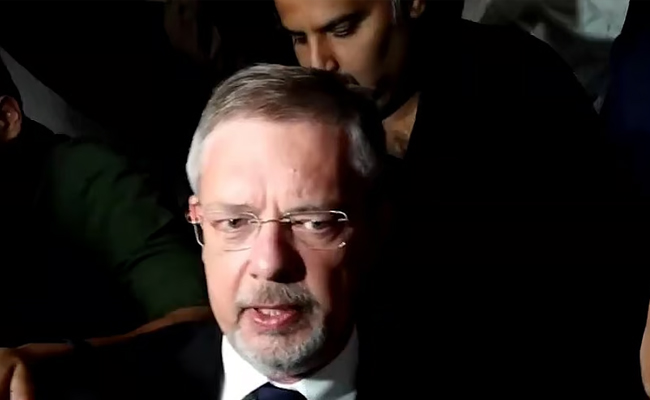

Congress president Mallikarjun Kharge said the Modi government's "reckless abdication" of India's strategic and national interests is there for all to see.

"An Iranian ship, a guest of India was returning, unarmed from the International Fleet Review 2026, hosted by us, and was torpedoed in the Indian Ocean Region (IOR). No statement of concern or condolence. PM Modi remains mute," Kharge said on X.

"Why lecture us on the doctrines of MAHASAGAR and India being a 'Net Security Provider' in the IOR, when you can’t react on what is happening in your own backyard? As many as 38 Indian Flag commercial ships along with 1100 sailors are stuck in Gulf of Hormuz," he said.

"Indian sailors, including Captain Ashish Kumar have reportedly died. Why is there no maritime rescue or relief operation in place? You say only 25 days of crude and oil stocks left. With rising oil prices, what is our energy contingency plan, especially in the wake of GOI virtually accepting the demand to stop import of Russian oil? What about the trade of other key commodities with the gulf countries?" the Congress chief said.

As per MEA statement on March 3, "some Indian nationals have lost their lives or are missing", he said.

"There are one crore Indians in the gulf region countries. Medical students are releasing desperate video messages seeking help. How is the GOI securing their well-being? Is there any evacuation plan in place from the affected areas?" Kharge said.

"Clearly, Modi Ji's SURRENDER is both political and moral! It demeans India’s core national interests and destroys our foreign policy carefully and painstakingly built and followed by successive governments over the years!" Kharge said.

Gandhi said the world has entered a volatile phase and "stormy seas lie ahead"

"India's oil supplies are under threat, with more than 40% of our imports transiting the Strait of Hormuz. The situation is even worse for LPG and LNG," he said on X.

"The conflict has reached our backyard, with an Iranian warship sunk in the Indian Ocean. Yet the Prime Minister has said nothing," Gandhi said.

At a moment like this, India needs a steady hand at the wheel, he said.

"Instead, India has a compromised PM who has surrendered our strategic autonomy," Gandhi alleged.

Congress general secretary in-charge communications Jairam Ramesh also said maybe it should not be surprising since the Modi government has still not broken its silence over the targeted assassinations in Iran.

In a significant escalation of the West Asia crisis, a US submarine on Wednesday torpedoed and sank an Iranian warship in international waters off Sri Lanka's coast when it was returning after participating in the Milan naval exercise, a multilateral wargame hosted by India.

In a post on X, Ramesh said the Indian Navy's flagship multilateral exercise, MILAN, was first held in 1995 and the 13th edition was held in Visakhapatnam from February 19 to February 25, 2026 with 18 warships from other countries, including the USA and Iran participating.

The exercise was inaugurated by Defence Minister Rajnath Singh, Ramesh pointed out.

"This makes yesterday's sinking of the Iranian warship that took part in the Milan exercise by a US Navy submarine in the Indian Ocean some 40 nautical miles south of Galle in Sri Lanka all the more extraordinary. The Iranian warship was on its way back home," he said.

This US action has enormous implications for India as well and it is shocking that there has been no official response to it till now, Ramesh said.

"Maybe it should not be surprising since the Modi government has still not broken its silence over the targeted assassinations in Iran. Never before has the Indian government looked so timid and fearful," the Congress leader said.

US Defence Secretary Pete Hegseth, confirming the strike, said at a Pentagon media briefing that it was the first sinking of an enemy warship by a torpedo since World War II.

The Associated Press, quoting the Sri Lankan Navy, reported that 87 bodies were recovered and that 32 people were rescued following the sinking of the warship IRIS Dena.

The incident marks a major escalation of the conflict between the US and Iran outside of the Persian Gulf and throws up questions relating to maritime security in the Indian Ocean that is largely considered as the backyard of the Indian Navy.

The US and Israel launched military strikes on Iran on February 28, killing Iranian Supreme Leader Ayatollah Ali Khamenei.

Following the military offensive, Iran has carried out a wave of attacks mainly targeting Israel and American military bases in several Gulf countries, including the UAE, Bahrain, Kuwait, Jordan and Saudi Arabia.

In the last few days, the conflict has widened significantly with attacks and counter-attacks by both sides.

India has called for resolving the conflict through dialogue and diplomacy.