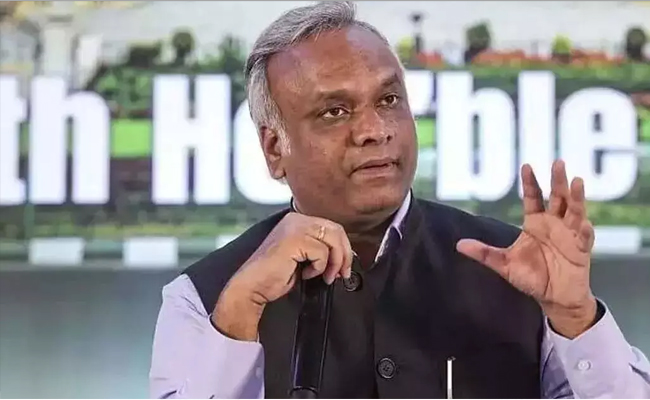

New Delhi: Public broadcaster Prasar Bharati is on the verge of finalising a Rs 15-crore per year deal with news anchor Sudhir Chaudhary for a one-hour show to be telecast on Doordarshan on weekday, The Indian Express reported on Friday.

A source familiar with the development stated that the deal is "certainly under consideration and will be signed soon," adding that the broadcaster frequently hires anchors for new shows. He pointed out that Rs 15 crore a year does not exceed the rates approved by the Central Bureau of Communication (CBC).

The new show, which is expected to occupy a prime-time slot on DD News, is slated to air from May. According to a memo discussed at a recent meeting held at Prasar Bharati, the broadcaster has approved a contract to “ESSPRIT Productions Pvt Ltd, represented by Chaudhary, to produce one-hour duration exclusive show from DD News (to air five days a week) at Rs 15 crore per annum plus GST, which will be subject to escalation at the rate of 10% every year,” IE added.

A negotiation committee formed by Prasar Bharati reportedly held five meetings with Chaudhary’s company to finalise the production costs. According to a source, the Rs 15-crore deal is within the range of Rs 28.6 crore for producing one-hour programmes of 260 shows annually as per the CBC rates.

This move is seen as part of Prasar Bharati’s strategy to revitalise DD News in the competitive news market. In addition to Chaudhary’s show, several other new programmes are planned, marking a shift toward a more multimedia-driven content approach for Doordarshan, sources familiar with the developments at Prasar Bharati said.

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

New Delhi (PTI): Dense fog disrupted flight operations at Delhi Airport on Monday, with various airlines cancelling 228 flights and diverting five to nearby airports due to low visibility, an official said.

However, except for Air India, which had in an X post in the morning announced the cancellation of some 40 flights, no other airlines, including crisis-hit IndiGo, shared the numbers of their cancelled or delayed flights.

"As many as 228 flights -- 131 departures and 97 arrivals-- have been cancelled due to low visibility, so far," the airport official said.

In addition to this, five flights have been diverted so far, he said.

Earlier, the Delhi International Airport Ltd (DIAL), in a statement, said, "Our on-ground officials are working closely with all stakeholders to assist passengers and provide necessary support across Terminals.

"Low visibility (below minima), due to dense fog, has severely impacted operations at Delhi and other airports across northern India, which is unfortunately beyond our control," IndiGo said in a statement.

As operations are adjusted to prevailing weather conditions, some flights may experience delays, while a few others may be proactively cancelled during the day to prioritise safety and minimise extended waiting at the airport, the airline said in a statement.

IndiGo, however, did not say how many of its flights were cancelled or delayed.

The airline said its teams are "closely monitoring" the situation and coordinating with Delhi airport.

ALSO READ: Messi's Delhi arrival delayed as fog disrupts flight

IndiGo also said it issued advisories to its customers and "proactively" informing them, to minimise inconvenience.

“Poor visibility due to dense fog in Delhi this morning has impacted flight operations for all airlines. We are closely monitoring conditions and will resume operations as soon as it is safe to do so,” Air India said in a post on X in the morning.

It also said that some flights have been cancelled In the interest of safety, and to avoid prolonged uncertainty for the guests, while listing out some 40 arrivals and departures that it had cancelled for the day.

Delhi airport is the country's busiest, handling around 1,300 flight movements daily.