Bengaluru: Shivaji Nagar MLA and Former Minister R Roshan Baig, who was on Monday night detained at BIAL Airport by SIT investigating the multi-crore IMA scam, was released on Tuesday.

According to the reports Baig has been asked by SIT to appear before it for the hearing on July 19.

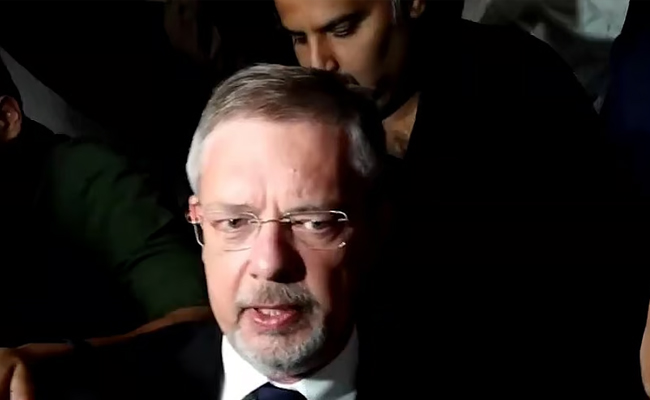

Speaking to reporters after his release, Baig added that it was a part of political conspiracy against him.

“The SIT thought I was fleeing from the investigations, but it is not like that. I am ready to co-operate with SIT for investigation” he said.

ALSO READ: IMA multi-crore scam: MLA Roshan Baig detained

ALSO READ: IMA Ponzi scheme; MLA Baig fails to turn up before SIT

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

New Delhi (PTI): A day after a US submarine torpedoed and sank an Iranian warship in international waters off Sri Lanka's coast, the Congress on Thursday questioned the government's silence with Rahul Gandhi saying that while the country needed a steady hand at the wheel, it has a "compromised PM who has surrendered our strategic autonomy".

Congress president Mallikarjun Kharge said the Modi government's "reckless abdication" of India's strategic and national interests is there for all to see.

"An Iranian ship, a guest of India was returning, unarmed from the International Fleet Review 2026, hosted by us, and was torpedoed in the Indian Ocean Region (IOR). No statement of concern or condolence. PM Modi remains mute," Kharge said on X.

"Why lecture us on the doctrines of MAHASAGAR and India being a 'Net Security Provider' in the IOR, when you can’t react on what is happening in your own backyard? As many as 38 Indian Flag commercial ships along with 1100 sailors are stuck in Gulf of Hormuz," he said.

"Indian sailors, including Captain Ashish Kumar have reportedly died. Why is there no maritime rescue or relief operation in place? You say only 25 days of crude and oil stocks left. With rising oil prices, what is our energy contingency plan, especially in the wake of GOI virtually accepting the demand to stop import of Russian oil? What about the trade of other key commodities with the gulf countries?" the Congress chief said.

As per MEA statement on March 3, "some Indian nationals have lost their lives or are missing", he said.

"There are one crore Indians in the gulf region countries. Medical students are releasing desperate video messages seeking help. How is the GOI securing their well-being? Is there any evacuation plan in place from the affected areas?" Kharge said.

"Clearly, Modi Ji's SURRENDER is both political and moral! It demeans India’s core national interests and destroys our foreign policy carefully and painstakingly built and followed by successive governments over the years!" Kharge said.

Gandhi said the world has entered a volatile phase and "stormy seas lie ahead"

"India's oil supplies are under threat, with more than 40% of our imports transiting the Strait of Hormuz. The situation is even worse for LPG and LNG," he said on X.

"The conflict has reached our backyard, with an Iranian warship sunk in the Indian Ocean. Yet the Prime Minister has said nothing," Gandhi said.

At a moment like this, India needs a steady hand at the wheel, he said.

"Instead, India has a compromised PM who has surrendered our strategic autonomy," Gandhi alleged.

Congress general secretary in-charge communications Jairam Ramesh also said maybe it should not be surprising since the Modi government has still not broken its silence over the targeted assassinations in Iran.

In a significant escalation of the West Asia crisis, a US submarine on Wednesday torpedoed and sank an Iranian warship in international waters off Sri Lanka's coast when it was returning after participating in the Milan naval exercise, a multilateral wargame hosted by India.

In a post on X, Ramesh said the Indian Navy's flagship multilateral exercise, MILAN, was first held in 1995 and the 13th edition was held in Visakhapatnam from February 19 to February 25, 2026 with 18 warships from other countries, including the USA and Iran participating.

The exercise was inaugurated by Defence Minister Rajnath Singh, Ramesh pointed out.

"This makes yesterday's sinking of the Iranian warship that took part in the Milan exercise by a US Navy submarine in the Indian Ocean some 40 nautical miles south of Galle in Sri Lanka all the more extraordinary. The Iranian warship was on its way back home," he said.

This US action has enormous implications for India as well and it is shocking that there has been no official response to it till now, Ramesh said.

"Maybe it should not be surprising since the Modi government has still not broken its silence over the targeted assassinations in Iran. Never before has the Indian government looked so timid and fearful," the Congress leader said.

US Defence Secretary Pete Hegseth, confirming the strike, said at a Pentagon media briefing that it was the first sinking of an enemy warship by a torpedo since World War II.

The Associated Press, quoting the Sri Lankan Navy, reported that 87 bodies were recovered and that 32 people were rescued following the sinking of the warship IRIS Dena.

The incident marks a major escalation of the conflict between the US and Iran outside of the Persian Gulf and throws up questions relating to maritime security in the Indian Ocean that is largely considered as the backyard of the Indian Navy.

The US and Israel launched military strikes on Iran on February 28, killing Iranian Supreme Leader Ayatollah Ali Khamenei.

Following the military offensive, Iran has carried out a wave of attacks mainly targeting Israel and American military bases in several Gulf countries, including the UAE, Bahrain, Kuwait, Jordan and Saudi Arabia.

In the last few days, the conflict has widened significantly with attacks and counter-attacks by both sides.

India has called for resolving the conflict through dialogue and diplomacy.