Bengaluru, Feb 28: Senior citizens and those with comorbidities against COVID-19 in Karnataka will be vaccinated at all taluk and district level hospitals and two identified private hospitals in each district from March 1, the state government said on Sunday.

People aged 60 years and above and those between 45-59 years suffering from specific comorbidities, supported by a certificate by a registered medical practitioner, will be vaccinated.

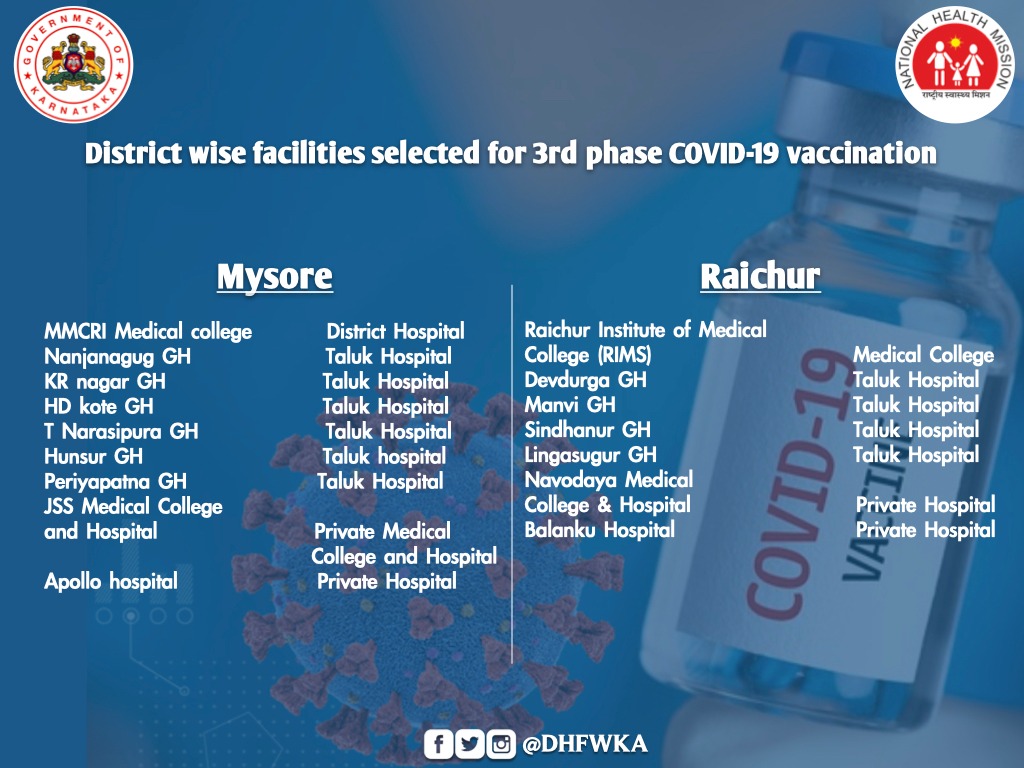

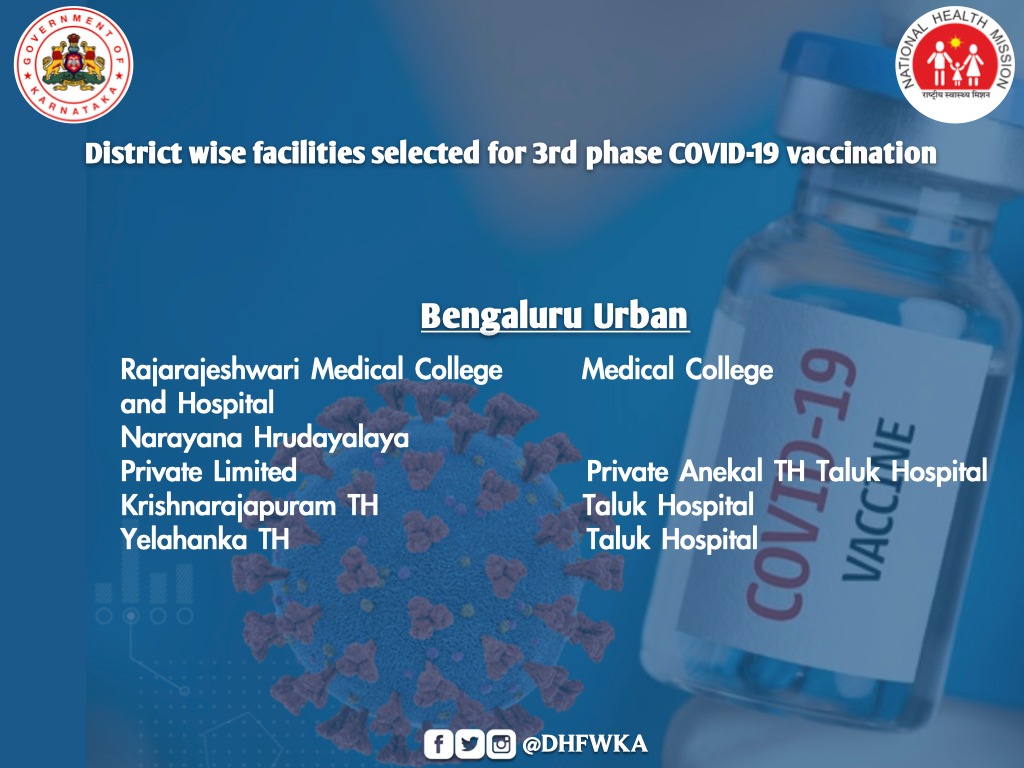

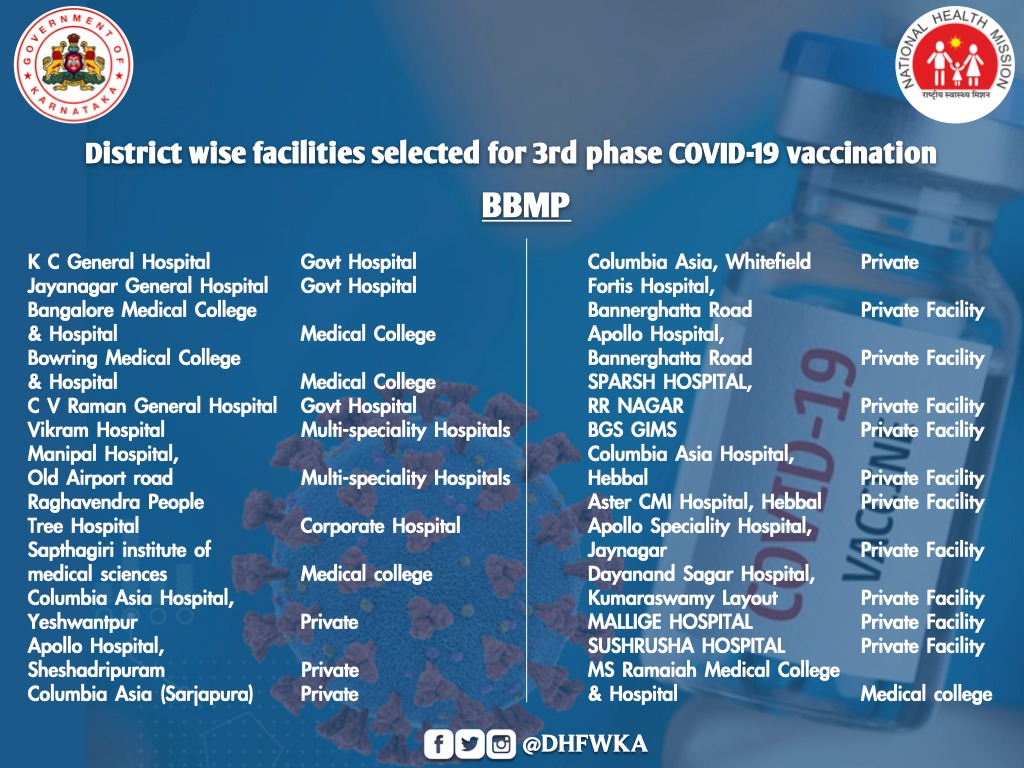

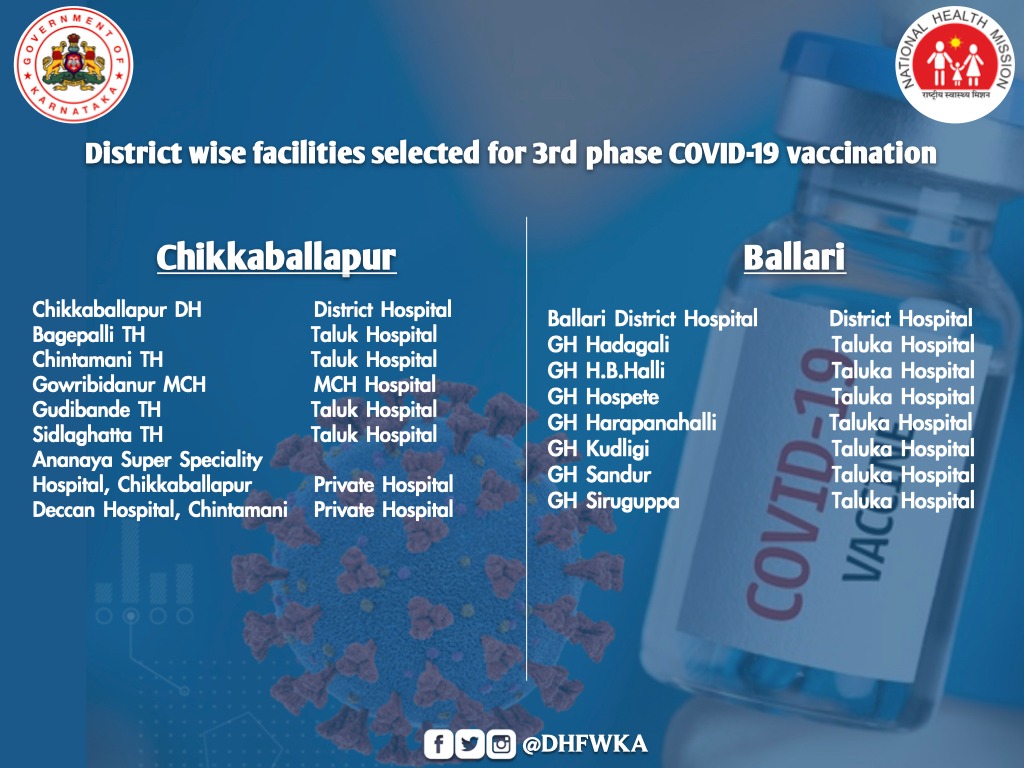

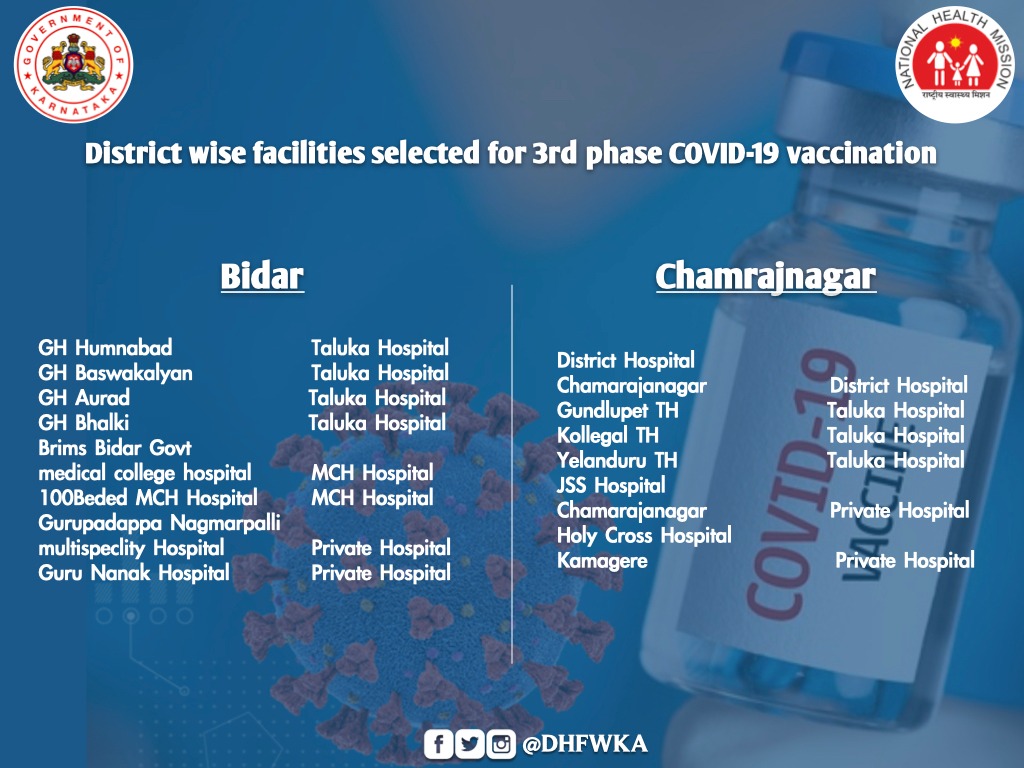

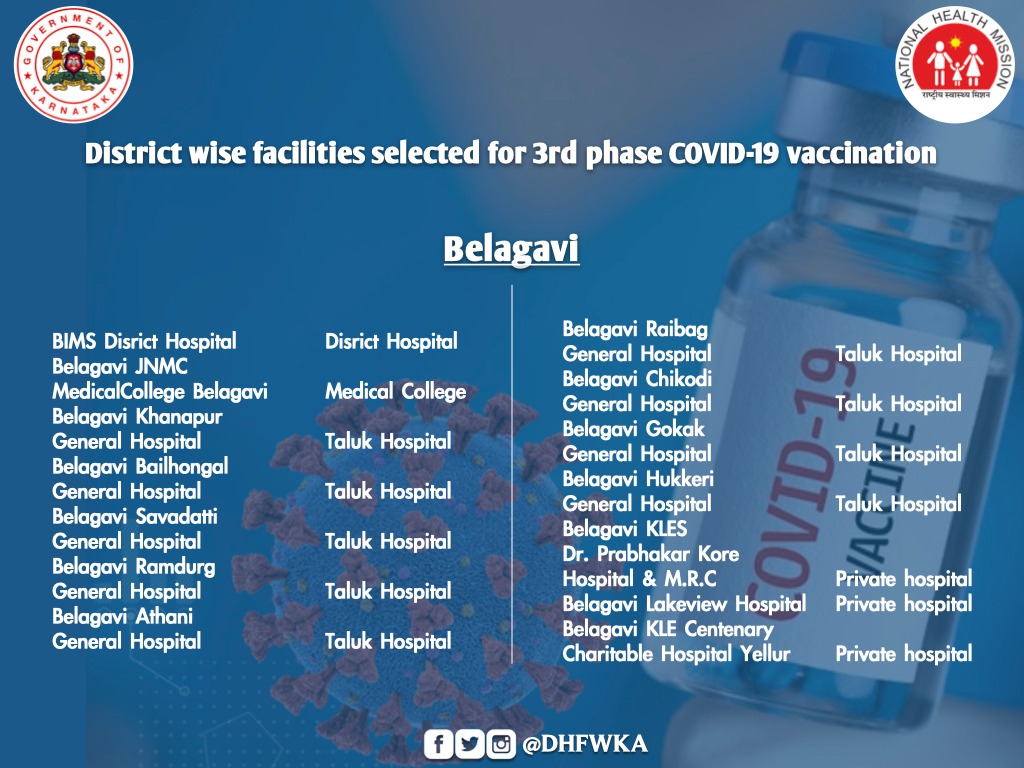

"In the initial phase, all taluk level hospitals, district level hospital and two identified private hospitals from each district and major hospitals of Bengaluru and 18 private health facilities from BBMP will implement COVID-19 vaccination from March 1,"a state health department note said.

In the initial days, vaccination will be only for online registered beneficiaries in urban and private facilities and both on-site and online in rural areas.

Moving forward, the vaccination for other modes of registration will be scaled up the number of facilities increased.

The vaccination would be held four days a week -- Monday, Wednesday, Friday and Saturday in government facilities and all working days in private hospitals.

The exercise, to be held between 12 pm to 5 pm, would later be modified, it said.

The number would be limited to 200 per day per session site and would be on a first come first serve basis.

However, online registered beneficiaries would be allotted a specific time in a day.

The vaccination will be free of charge at the government Vaccination centres, while those taking the shot at any designated/empaneled private health facility have to pay Rs 250 each for a dose, which includes Rs 100 service charge and Rs 150 which would be deposited to Government of India specified account, it added.

The nationwide COVID-19 Vaccination drive was launched on January 16 and has been limited to health care workers and front line COVID warriors.

The beneficiaries will be able to self-register in advance by downloading the COWin 2.0 portal and through other IT Applications such as Arogya Setu.

Facility of on site registration allows those who cannot self-register in advance to walk into the identified COVID vaccination centres and get themselves registered on-site and then vaccinated.

Healthcare workers and frontline staff who have missed the shots or been left out of the current vaccination drive can also select vaccination centres of their choice, the release said.

PC: @DHFWKA

Let the Truth be known. If you read VB and like VB, please be a VB Supporter and Help us deliver the Truth to one and all.

Mumbai (PTI): The rupee witnessed high volatility in early trade on Wednesday, as support from easing crude oil prices was offset by uncertainty over the India-US trade deal and persistent foreign fund outflows.

Forex traders said the key driver of rupee weakness in December was continued FPI selling across both equity and debt markets, with foreign investors repeatedly selling several billion dollars’ worth of Indian assets on a daily basis in the last few months, the selling intensifying in the last two months.

ALSO READ: Rupee falls 9 paise to record low of 90.87 against US dollar in early trade

However, with Brent crude oil prices hovering near recent multi-year lows of USD 59 per barrel, the local unit was supported at lower levels.

At the interbank foreign exchange market, the rupee opened at 91.05 against the US dollar, down 12 paise from its previous close.

The domestic unit, however, witnessed a sharp recovery and appreciated 97 paise to touch an early high of 89.96 against the American currency and was trading at 90.18 against the US dollar at 09.46 hrs.

On Tuesday, the rupee tanked below 91 per dollar, hitting a low of 91.14. It finally settled at 90.93 against the American currency.

Meanwhile, the dollar index, which gauges the greenback's strength against a basket of six currencies, was trading 0.17 per cent higher at 98.31.

Brent crude, the global oil benchmark, was trading at USD 59.54 per barrel in futures trade, as record non-OPEC supply, weak China data and optimism over a Ukraine ceasefire were the main reasons for the current fall, traders said.

Meanwhile, Minister of State for Finance Pankaj Chaudhary on Tuesday informed Parliament that, "During the current financial year, the depreciation of the INR has been influenced by the increase in trade deficit and likely prospects arising from the ongoing developments in India's trade agreement with the US, amid relatively weak support from the capital account."

"The depreciation of currency is likely to enhance export competitiveness, which in turn impacts the economy positively. On the other hand, depreciation may raise the prices of imported goods. However, the overall impact of exchange rate depreciation on domestic prices depends on the extent of the pass-through of international commodity prices to the domestic market," he said.

On the domestic equity market front, the 30-share benchmark index Sensex was trading 146.09 points higher at 84,825.95, while the Nifty was up 62.05 points at 25,922.15.

Foreign Institutional Investors sold equities worth Rs 2,381.92 crore on Tuesday, according to exchange data.

According to Anil Kumar Bhansali, Head of Treasury and Executive Director, Finrex Treasury Advisors LLP, the rupee may see a slow and steady move towards 92 in the coming days, with no signs of any trade deal happening between India and the US, which has also been a cause for the equities to fall.